Hey, jams and jellies one day , the energy and telcom sectors the next. Sounds like a plan:

TreeHouse Foods' purchase is latest income fund sold to foreigners since Flaherty's Halloween announcement

by JOHN PARTRIDGE, June 26, 2007

If it had not been for Ottawa's surprise attack on income trusts last Halloween, E.D. Smith & Sons Ltd., the iconic Canadian jam and sauce maker, would almost certainly still be pursuing the aggressive strategy it launched two years ago - on its own.

Instead of continuing to expand into the United States and broadening its product line, the capital-strapped income trust that owns the 125-year-old Winona, Ont., firm is selling out to a U.S. company for $217-million or $9.15 a unit in cash. It is blaming federal Finance Minister Jim Flaherty's controversial decision for the move that will end its independence.

The announcement yesterday of the sale to TreeHouse Foods Inc. of Westchester, Ill. came just over six months after E.D. Smith slashed distributions to unitholders, parted company with then president and chief executive officer Michael Burrows and hired Toronto investment bank Genuity Capital Markets to conduct a strategic review.

"I would say it's highly unlikely this process would have taken place without the change in the legislation," Bruce Smith, the company's chief financial officer - but not a member of the founding family - said when reached at head office. "It created challenges for us to raise capital and was one of the leading reasons we got into this strategic review process."

Like any chief executive officer worth his or her salt, E.D. Smith's acting CEO Martin Thrasher would probably have preferred to keep the company forging ahead independently. But he diplomatically declined to say so when reached yesterday afternoon.

"It's really not a matter of preference," he said. "We have to deal with the realities of the marketplace. We have really transformed this company in the last two years, and, yes, we have some very aggressive growth ambitions.

"That's why we think this match-up with TreeHouse works so well."

Close to 20 publicly traded income trusts have been sold - mostly to foreigners and private equity firms - or put up for sale since Mr. Flaherty's controversial announcement, although he has rejected suggestions the decision to tax trusts down the road is to blame.

On Friday, the Senate approved Bill C-52, which includes the trust tax.

E.D. Smith was incorporated in 1882, but traces its roots to 1878, when its namesake founder, Ernest D'Israeli Smith, then a bachelor farmer, later a married MP and then Senator, began growing strawberries at his property in Ontario's Niagara Peninsula. It now produces jams, salad dressings and other sauces both under its own brand and for private labels.

The senator's great grandson, Llewellyn Smith, sold the family company to Imperial Capital Corp., a private equity firm in Toronto, in 2002, and in May, 2005, Imperial took the food processor public as an income trust in an initial offering that raised $110-million at $10 a unit.

TreeHouse, which bills itself as the largest maker of pickles and non-dairy powdered creamers in the United States, also will assume E.D. Smith's existing debt and the costs of the transaction. This will put the total value of the transaction at $313-million, Mr. Thrasher said during a conference call with analysts.

Assuming the TreeHouse deal is consummated, unitholders should receive up to $9.15 a unit, less a holdback of up to 60 cents to cover certain expenses, the fund said.

This is $1.71 or 23.3 per cent higher than the price of $7.34 at which the units closed on the Toronto Stock Exchange Friday, but is $3.04 below the all-time high of $12.19 they hit in August, 2005.

The takeover must be approved by two-thirds of the votes cast at a special meeting the fund will hold for unitholders and is expected to close by the end of August, E.D. Smith said.

TreeHouse, which is more than four times larger than E.D. Smith, has the right to match any competing offer and would be paid a termination fee of $8-million if the Canadian firm's board of trustees decides to accept another bid, the fund said.

However, the board is unanimously recommending acceptance of the U.S. firm's offer. "We have conducted an extensive review of the strategic alternatives available ... and believe this deal provides our unitholders with an attractive price for the business and a material premium to the recent trading level of the units," Jack Scott, the fund's chairman, said in the statement.

Tuesday, June 26, 2007

Ottawa blamed for E.D. Smith sellout

Posted by

Fillibluster

at

1:51 PM

2

comments

![]()

![]()

Tuesday, June 19, 2007

Incriminating Serge Nadeau sighting

Serge Nadeau is the Director General of Tax Policy in the Department of Finance that was charged by the RCMP with alleged insider trading in connection with the purchase of income trusts in advance of a favourable tax treatment announcement by the Government in 2005. No Finance Minister can be held responsible for the alleged illegal activities of his department's staff. That said, Jim Flaherty went to some lengths at the time of Nadeau's arrest to assure Canadians that Serge Nadeau, who was actively involved in the 2005 income trust tax policy review, had no role whatsoever in the policy review of October 2006.

Attached is the memo that Steven Chase based his Globe and Mail article of yesterday on, entitled Trust tax linked to private equity buyouts. This memo was dated October 30, 2006 and was addressed to Bob Hamilton who is senior assistant deputy minister of tax policy at the Finance Department. This memo dealt with the positive impact that income trusts had in thwarting foreign private equity takeouts. The memo was copied to two individuals, one of whom is Serge Nadeau. If we are to believe Jim Flaherty's claim that Serge Nadeau had no role in the formulation of the October 2006 income trust tax, why then is it that he is one of only three people in the Department of Finance to receive this memo dated October 30, 2006? Bob Hamilton is the ADM of Tax Policy, Serge Nadeau is the Director General of Tax Policy. Clearly both were involved, as one would normally expect given their titles and area of focus, namely tax policy.

The sanitized /blacked out version of the memo contains some very disturbing information, not all of which was covered by Steven's excellent article, and touches not only on the foreign takeover vulnerability associated with the income trust tax but also the negative income tax collection consequences of what the policy would induce. This is contained in the second of the three summary findings of the memo. The more incriminating third point is blacked out.

Summary observation two reads:

"Second, the factors that have been driving the increased presence of foreigners in the Canadian private equity market are not cyclical, which suggests that foreigners will remain active players in Canada. These factors include the availability of favourable tax structures that can reduce Canadian tax liability."

Elsewhere in the memo it reads: "Canada is very attractive for foreign buyout firms because of the highly efficient tax structures they can use to finance their acquisitions."

Elsewhere it states: "private equity firms consider income trusts as a serious competitor and an attractive option for the managers of targeted firms."

So what does Flaherty do with this input? Does he redress the measures that make things attractive for foreign private equity takeovers. No, he does the exact opposite. He taxes trusts, thereby making them highly vulnerable to foreign private equity takeover with the knowledge that private equity owners will reduce the Canadian taxes paid. For extra good measure he also then takes a situation that is already highly tax efficient for foreign private equity to buy Canadian businesses and makes it even more efficient by eliminating the 15% withholding tax on leveraged buyout debt as part of Budget 2007.

Therefore his plea of "it's not my fault" rings hollow. Literally. It was Flaherty's fault. It was premeditated. It was with full knowledge of the negative consequences to Canada's tax base and Canada's economic sovereignty. Truly a disgrace.

CLICK FOR FULL SIZE IMAGE

CLICK FOR FULL SIZE IMAGE

CLICK FOR FULL SIZE IMAGE

Do you want to Email, Fax or Print these documents? Click here.

Posted by

Fillibluster

at

2:32 AM

10

comments

![]()

![]()

Sunday, June 17, 2007

BCE's new shareholders: Locusts or Barbarians?

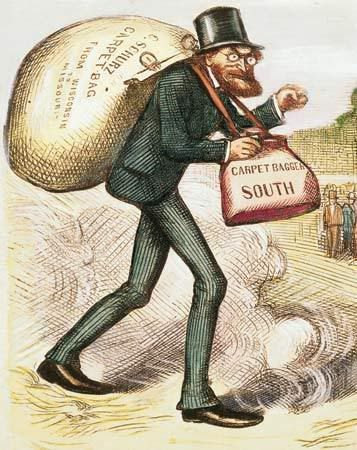

Or dare I say Carpetbaggers?

At present there are three private equity bidding groups vying to take BCE private. They are all dominated by US private equity firms, namely KKR, Cerberus and Alliance.

Henry Kravis of KKR was commenting recently on whether he prefers the term “locusts” or the older terminology of “barabarian” to describe the rapacious capital called private equity. Here’s what he had to say:

"I was disappointed with that term," said Mr. Kravis, whose firm is also the subject of a book and a film by the same name, Barbarians at the Gate, about its US$25-billion takeover of RJR Nabisco Corp. "I went from barbarian to locust," said Mr. Kravis. "I think I preferred barbarian."

Meanwhile, we get what simply amounts to hollow assurances from a wholly vested party, namely John Snow the Chairman of Cerberus, that a purchase of BCE by his consortium would not constitute “hollowing out” and so we should all go back to sleep, knowing that the three headed dog who guards hell’s gates (definition of Cerberus) has our best interests as a nation at heart by parsing the issue this way:

“Hollowing out is where you have a strategic buyer who decides we're going to have a branch office here, but we're really going to run this from wherever. That's not this case. We've made it clear the management team will stay, and that Montreal stays the headquarters.”

Given that these two gentlemen reject these descriptive terms, I have a new one for them to consider that aptly describes who they are and what they are up to. It derives from the history of their own country of origin. Except in this case, we are the failed state that is being exploited by our neighbours to the south who are being aided and abetted by Canada’s New Government and their compliant accomplices in the federal bureaucracy through favourable tax measures, many contained in the pending Budget:

CARPETBAGGERS (From Wikipedia)

"In United States history, carpetbaggers were Northerners who moved to the South during Reconstruction between 1865 and 1877. They formed a coalition with Freedmen (freed slaves), and Scalawags (Southern whites) in the Republican Party, which in turn controlled ex-Confederate states for varying periods, 1867–1877.

Carpetbaggers was coined from the carpet bags used as inexpensive luggage. It was originally a derogatory term, suggesting an exploiter who does not plan to stay. Although the term is still an insult in common usage, in histories and reference works it is now used without derogatory intent. Since 1900 the term has also been used to describe outsiders attempting to gain political office or economic advantage, especially in areas (thematically or geographically) to which they previously had no connection."

That sounds about right.

Posted by

Fillibluster

at

5:53 PM

2

comments

![]()

![]()

Friday, June 15, 2007

While Rome is burning

You really have to marvel at all these righteous politicians who are making major hay on the equalization issue. Not that I disagree with them for a moment that a signed contract and a solemn election pledge need to be faithfully honoured by the Prime Minister. However I’m not sure that I am sympathetic with the essence of the argument that resource revenues are phantom revenues for purposes of equalization payments. But then that’s their shtick, not mine. What I do marvel at is the extent to which these politicians and the media heap attention on a discussion that amounts to people arguing over what constitutes their “equal” slice of the pie, and meanwhile the overall pie is shrinking before our very eyes and no one seems to either get it or care.

A dispute at the margin takes center stage over a destruction of the stage itself. So what is the quantum of the equalization dispute? One billion over 11 years or something of that magnitude. Hardly chump change, however there are no hard and fast numbers unless you are endowed with the ability to predict with certainty future energy prices over the next decade.

Meanwhile Rome is burning on a socio-economic basis. The entire income trust sector and income trust conversion candidates like BCE and Telus will be quickly scooped up by predominantly foreign private equity over the next 6 to 18 months and no one seems to care. Seniors’ income will be halved as a result, and no one seems to care. One need not have a crystal ball or even make any adventuresome assumptions to quickly come to the realization that about $7.5 billion in ANNUAL taxes to various governments in Canada is at stake and will soon disappear. I repeat $7.5 billion a year. That’s the equivalent of a 1.5% GST hike. Do you think Canadians would be blithely indifferent about a 1.5% GST hike?

For a budget that Flaherty promised would put an end to decades of federal/provincial bickering, I would suggest that a couple of Provincial Premiers who are on the sidelines of today’s round of ongoing federal provincial bickering, namely Dalton McGuinty and Ed Stelmach take up the charge of the bigger pie that is at stake before someone eats our lunch. Do these gentlemen not realize that almost the entire income trust sector resides within their borders and well over half the investors as well? Does Dalton McGuinty not know that the bulk of Canada’s financial services industry and investment community resides in Toronto? More enlightened politicians like New York Mayor Michael Bloomberg are alert to the shifting sands of economic well being and he is proactively taking measures to preserve New York’s leadership in its essential areas, as he recently commissioned a study that he will be acting on that looked at why New York is losing dominance in Global Financial Services to the City of London. But then he’s a businessman first and a politician second and therefore is equipped to detect the smell of Rome burning in sufficient time to act accordingly.

The precipitous drop in the Canadian IPO activity reported on in today’s Globe and Mail is not some temporal phenomenon, rather it is a systemic and structural change that bodes only ill for Canada. Take my word for it. Since when does IPO activity dry up at a time of record stock market levels? The investment demand for the “next best thing” has been superceded by the investment demand of an aging population for the “next prudent thing.” That was income trusts. Even today’s opponents of income trusts of all stripes will come to rue the day that this market’s dynamism and inherent sovereignty preserving dimensions were fiddled with by Flaherty. The child called The Tax Fairness Plan is sure to become of orphan that none of its original progenitors will lay claim to even have known. Success has many fathers, outright inevitable failures of this magnitude are orphans that are certain to leave Canadians and Canada impoverished on a net economic basis.

Meanwhile our political leadership is crying over spilt milk and their piece of an ever dwindling economic pie. It’s high time Canadians and their politicians attuned their sense of smell. Survival of the fittest depends upon it. Are we to be a survivor or someone else’s next meal?

Posted by

Fillibluster

at

12:05 PM

2

comments

![]()

![]()

Wednesday, June 13, 2007

Canada's New Government is working at cross purposes with the interests of the broad electorate

Take your pick of poison, whether it’s the alleged torture of Afghan prisoners, honouring the Atlantic Accord or the taxation of income trusts, Canada’s New Government is working at cross purposes with the interests of the broad electorate, a small percentage of whom were responsible for electing them into office. Recent polls would clearly suggest that an even smaller percent would elect them to office this time around. Yesterday’s New is today’s Old and tomorrow’s Same Old, Same Old.

I have a particular interest in the income trust tax matter, in that it was the original sin of this government of ours. Many had predicted at the outset that the resultant decline in the market value of these public income trusts, combined with the cash flow rich nature of the underlying businesses involved, would ensue in a wave of foreign takeover of these income trusts, lead by foreign private equity. Happy Halloween would be followed by happy hollowing. Sure enough, the pent up demand that resulted was so competitive in nature that many didn’t wait for the ill-conceived legislation to pass and they acted preemptively. To date some 19 income trusts totaling $10 billion have been acquired. !5 by foreigners. Finance Minister Jim Flaherty’s thoughtful response: “it’s not my fault”.

We always knew that this was a preposterous response. We also now know it to be patently false, as documents obtained by Globe and Mail reporter Steven Chase reveal otherwise. In the internal Finance memo to Assistant Deputy Minister of Finance Bob Hamilton, Steven sums up the content of the memo by saying: “ one conclusion that's easily drawn from the memo is that taxing trusts out of existence would likely usher in even more private equity buyouts by Canadian and foreign investors, which is what happened”. What’s the official Finance response? “Finance Canada spokesman David Gamble played down the memo, saying it's merely a summary of one of many conferences attended by his department”.

Well, Milton Friedman warned us about people like David Gamble and Bob Hamilton and others in Finance like ex-Goldman Sachs investment banker Mark Carney who are proponents of taxing the living existence out of public income trusts for the ultimate benefit of foreigners and to the detriment of all Canadians who will have to supplement the loss of some $6 billion in taxes. Milton Friedman said:

“The danger of the Galbraithian view is that it stresses the importance of the expansion of the government's role. Unfortunately, while he assumes that the government is carried out by disinterested intellectuals, it will not be. It will be carried through by very highly interested bureaucrats, and they will run society from the centre, as such societies have always tended to be run: as collectivist societies which reduce and greatly limit the freedom and choices of individuals." How correct he was as this whole situation was dreamt up by a handful of bureaucrats at the DoF who want to impose their view of the "correct form" of business organization on all Canadian businesses.

There are obviously those in Finance who look for ways to benefit from upcoming tax changes. Serge Nadeau, is perhaps the most criminal example. However the greater crime may be those in Finance who look for ways, as Friedman suggests, to bring their vision of correctness to bear, on behalf of those whose agenda they are serving. It is clear whose agenda is being served here by the taxation of public income trusts at five times the effective tax rate of corporations band the double taxation of RRSPs. You need only look at the legislation to find out: Foreign Private Equity. Canadian Pension Plans, large and small. Marketers of competing investment products, most notably life insurance companies, Corporate Canada, and Foreign Oil. How much more at cross purposes can Canada’s New Government be at with the interests of the broad electorate?

Meanwhile the NDP is the all important Enabler of this hoax of a tax policy. Have Jack and Judy figured it out yet, or do they prefer to be educated one all candidates meeting at a time in the next election? So too perhaps the Bloc. So too, the Provincial Finance Ministers like Ontario’s Greg Sorbara who dutifully sent in supportive letters, without even asking for the supporting proof of tax leakage. Whose idea of public service is that?

Posted by

Fillibluster

at

12:20 PM

6

comments

![]()

![]()