Mr. Ted Menzies MP.

Parliamentary Secretary to the Minister of Finance

Dear Mr. Menzies:

I understand that you will be conducting consultations across Canada on the legislative and regulatory framework for federally regulated private pension plans, and will be in Toronto on March 20, 2009.

I wish to participate in those discussions and to make a submission to you at that time.

Our association represents the interests of over 2.5 million Canadians who own income trusts and the over 75% of Canadians who are not members of defined benefit pension plans.

The matters of policy interest to our association are:

(1) We wish to understand how Canadians and the Canadian Public Capital Markets, benefit from the policy measures contained in your government’s Tax Fairness Plan, which tax income trusts that are Publicly Listed at 31.5% (and are subjected to restrictive growth provisions) whereas those self same income trusts if taken private are not? This has lead to a rash of takeovers of undervalued trusts held in RRSPs, by Private Pension Funds like OMERs, PSP, Caisse, etc. It has become a government exercise of robbing Peter to pay Paul, in which Peter is the average Canadian saving for retirement and Paul is the Government sponsored pension plans.

What is the policy intent of this? RRSPs are being placed at a profound economic and savings disadvantage, when RRSPs were originally set up by government to serve as the common man’s version of pension plans? How is this consistent with your stated policy goal of the Tax Fairness Plan, which ostensibly was to ‘level the playing field”?

(2) I wish to provide you with first hand information of the abuses of Pension Funds such as Ontario Teachers’ (OTTP) with respect to their use of mechanisms (McCague Holdings for example) designed with the sole intent of circumventing OTTP’s federal regulations, which otherwise restrict their voting ownership of Canadian corporations to 30% or less. This abuse arouse in Ontario Teachers’ proposed purchase of BCE Inc., which is a transaction that I opposed in interventions before the CRTC and the Supreme Court of Canada, on the very basis that this acquisition contravened the Pension Benefits Standards Act.

Please let me know the details of your trip to Toronto and the best time for a meeting with you and members of our association.

Thank you in advance.

Yours truly,

Brent Fullard

President and CEO

Canadian Association of Income Trust Investors

www.caiti.info

647 505-2224 (cell)

Cc. Hon John McCallum

Cc. Thomas Mulcair

Cc. Paul Crete

Cc. Elizabeth May

Friday, February 27, 2009

National Consultations on Private Pensions

Posted by

Fillibluster

at

3:18 PM

2

comments

![]()

![]()

Thomas Mulcair needs to awaken to his own insights

Thomas Mulcair is the Deputy Leader of the NDP and his party’s Finance Critic. Thomas Mulcair was on CBC yesterday with Don Newman explaining the perils of this $3 billion ”slush fund” that has been set aside by Flaherty as part of the Budget.

Mulcair said that governments will often exploit matters of legitimate national concern and turn them into situations of their own advantage for themselves and their friends. Mulcair charged that the Harper government is using Canadians’ legitimate concern about the need for stimulus and using that opportunity as his excuse to create this highly unorthodox discretionary spending fund, a situation that is rife for abuse.

Mulcair drew a parallel to how the concern over national unity that followed the close outcome of the 1995 referendum, provided the rationale for the creation of a similar discretionary type fund known as the Sponsorship Fund. We all know how that worked out and how Ottawa’s bureaucracy “gamed” Canadians and taxpayers.

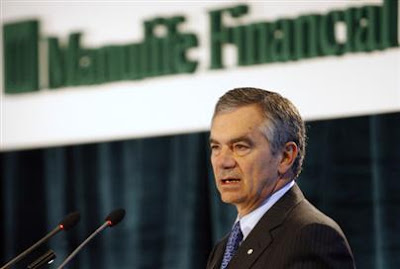

Meanwhile, Thomas Mulcair and the entire NDP remain oblivious to the fact that they have been similarly duped and gamed by the Ottawa bureaucracy and by the Harper government on the income trusts issue. Is the NDP so dense that they can’t realize who this policy was designed to benefit? Namely Manulife Financial and Great West Life. Namely US foreign private equity firms like Brian Mulroney’s Blackstone Capital, Cerberus Capital, Goldman Sachs and KKR? Namely foreign corporations like Abu Dhabi Energy, Begium’s Interbrew and Cheung Kong Holdings of Hong Kong? Wake up NDP, the evidence is irrefutable, and yet the rationale for the policy is non-existent.

This entire hoax of a tax policy was perpetrated on the premise that a matter of grave national urgency was involved, namely the assertion that income trusts cause tax leakage. So where’s the proof apart from 18 pages of blacked out documents? Is that what the NDP stands for? Government shrouded in secrecy and the use of blacked out documents? Meanwhile we know for a fact that income trusts do not cause tax leakage. Tax leakage was an argument that Mark Carney falsely contrived to serve ends that are opposed to the interests of all Canadians, except a handful of very powerful people that the NDP profess to have the courage to stand up to?

I have one question for Tom Mulcair, who strikes me as an honest and intelligent person. On what basis, and with what for proof, have MPs of your party written the following, en masse, to their constituents.

“Dear constituent: I have spoken with Judy Wasylycia-Leis, our party’s Finance Critic, she is confident that the government’s estimates of future tax leakage are accurate.”?

.....or is this just another sponsorship scandal in the making with the NDP cast in the role of Chuck Guité, compliant instrument of government corruption. After all, the income trust tax and all its foreign related takeovers, is costing Canadian taxpayers over $1 billion in lost taxes PER YEAR, a number that will soon grow to $7 billion PER YEAR, unless something is done to uncover Mark Carney’s lies about alleged tax leakage:

By blindly accepting the lies of the Harper government at face value, the NDP are making themselves complicit in this crime. By exposing the lies of the Harper government, the NDP have the opportunity to be heroes. Which is it Mr Mulcair? Complicit in lies or heroes? Time is running out. It's time for something new from the NDP.

Posted by

Fillibluster

at

11:24 AM

1 comments

![]()

![]()

Our Finance Minister - infamous for saying "It's not my fault"

It's not my fault.

Really, It’s not my fault.

You gotta believe me, it’s not my fault.

Blame Mark Carney. It’s his fault!

Blame Mark Carney. He’s the one who invented the tax leakage lie.

Posted by

Fillibluster

at

9:37 AM

3

comments

![]()

![]()

Unlike Obama, Harper hides behind the truth: Watchdog blasts Tories for secrecy obsession

Many people, including the CEO of a large Canadian media company, have asked me why I have doggedly pursued the income trust matter for so long, My answer was simple. Unlike him, I refuse to be lied to by my government. This combined with the fact that since November 1, 2006 I have known that Stephen Harper’s allegation that income trusts cause tax leakage was a demonstrable lie, for anyone who wanted to lift a finger to find out. Those unwilling to lift a finger were all the members of the NDP and Conservative Party, and about 98% of Canada’s Main Stream Misleadia, who seem intent on making themselves ever more irrelevant with each passing day.

How many of you think that Canadians should lose $35 billion of their savings based on a blatant lie?

Watchdog blasts Tories for secrecy obsession

Information chief challenges Ottawa to ease 'stranglehold'

Feb 27, 2009 04:30 AM

Toronto Star

OTTAWA–A secretive Conservative government shares the blame for an access-to-information system that is dogged with delays and on the brink of "crisis," a scathing report says.

Information Commissioner Robert Marleau issued a hard-hitting condemnation yesterday of Ottawa's "risk-averse, disclosure-averse" atmosphere that denies Canadians the information they're entitled to about the workings of the federal government.

And he singled out the Conservatives' "stranglehold in the centre on communications" and challenged Ottawa's "tendency to withhold information."

President Obama's Open Government: A significant step forward for our democracy.

January 23, 2009

World Resources Institute

On his first full day in office, President Obama issued an Executive Order and several memoranda on transparency and participation in the Federal Government. This is a welcome and significant step forward for our democracy.

The new President’s directives aim to close the revolving door between the federal government and lobbyists, instruct federal agencies to make decisions in the open and facilitate disclosure of presidential records.

“My Administration is committed to creating an unprecedented level of openness in Government,” Obama indicated. Circulated to the heads of agencies and departments, this presidential guidance will prompt them to make government information available to the public and foster public participation in the making of decisions.

The Specifics

Ease Access to Information: The President is instructing the heads of federal agencies to interpret the Freedom of Information Act (FOIA) with a presumption that government information should be made available to the public. The national security and privacy exemptions contained in the 1966 law have too often been used by public officials to conceal abuses of power and errors in situations where the public had a legitimate right to know. President Obama’s statement is clear: “The Government should not keep information confidential merely because public officials might be embarrassed by disclosure, because errors and failures might be revealed, or because of speculative or abstract fears.” “In the face of doubt, openness prevails,” he added.

Limit the Scope of Claims of Executive Privilege: President Obama’s Executive Order ensures that citizens have greater access to presidential records and communications. Executive privilege can be claimed to withhold presidential documents from the public in the narrow instances where “national security (including the conduct of foreign relations), law enforcement, or the deliberative processes of the executive branch” would be impaired. However, the new Order’s exemptions from disclosure are much narrower than its predecessor’s and aim to reduce the number of instances where former presidents and their heirs can withhold information from the public.

Affirmative Disclosure of Information: The public’s right to be informed about decisions and facts that affect it should encompass a duty on the part of the government to proactively disclose and disseminate information that is relevant to affected communities. The President, in a welcome clarification informed its Administration that “the presumption of disclosure also means that agencies should take affirmative steps to make information public. They should not wait for specific requests from the public. All agencies should use modern technology to inform citizens about what is known and done by their Government.”

Renewed Emphasis on Public Participation: This will ensure that decisions best reflect the interest of the public and benefit from the greatest level of possible expertise. “Government should be participatory,” the President wrote. “Public engagement enhances the Government’s effectiveness and improves the quality of its decisions.” He added that “executive departments and agencies should offer Americans increased opportunities to participate in policymaking and to provide their Government with the benefits of their collective expertise and information.”

New Technologies: The internet’s interactive features will be used to better disseminate government information to a wide audience and increase the level of public participation in decision-making. An early sign of this trend is the new whitehouse.gov website. This interactive platform will enable the public to track, review and comment on decisions made by the head of the executive. President Obama has also signaled his intent to follow through on a campaign promise to make all non-emergency bills available for public comment before signature.

Restoring Scientific Integrity in the Federal Government: This has been a campaign promise of Obama which was echoed in recent speeches as well as in his inaugural address. The President vowed to restore science to its rightful place. This initial statement along with the memoranda of the next day suggest a will to ensure that heads of agencies respect the advice of technical and scientific experts, pursue the non-partisan prosecution of the law and interpret legal provisions in a non-partisan and even-handed manner. President Obama should follow through on these remarks and ensure that the political review and communication of findings does not undermine the integrity and independence of scientific data and analysis.

Posted by

Fillibluster

at

9:03 AM

1 comments

![]()

![]()

Thursday, February 26, 2009

Conservative MP Ted Menzies declares Harper's Accountability Act is not credible

In Question Period today:

Hon. John McCallum (Markham—Unionville, Lib.): Mr. Speaker, Is the minister going to admit his mistakes future, as when he gave an illegal contract to his friend, or is he going to hide, as in the case of the broken promise on income trusts and the famous 22 pages of redacted documents? In terms of future mistakes, what degree of transparency can we expect?

Mr. Ted Menzies (Parliamentary Secretary to the Minister of Finance, CPC): Mr. Speaker, this government is all about transparency. In fact if we recall, this government is the one that brought forward an incredible Federal Accountability Act.

in⋅cred⋅i⋅ble /ɪnˈkrɛdəbəl - adjective

1. so extraordinary as to seem impossible:

2. not credible; hard to believe; unbelievable:

Posted by

Fillibluster

at

6:07 PM

1 comments

![]()

![]()

Flaherty starring in Slush Fund Millionaire

Government unveils $3-billion stimulus stash

Thu. Feb. 26 2009

The Canadian Press

OTTAWA -- The federal government has announced plans for a $3-billion emergency fund so it can begin pumping out economic-stimulus money in just over a month.

That special fund is designed to get cash flowing to projects far sooner than June, when the budget's supplementary estimates would normally be adopted by Parliament.

The money could start flowing by April if the fund receives parliamentary approval.

The announcement by Treasury Board President Vic Toews comes a day after a cabinet colleague conceded that the current spending stampede could result in some waste.

Finance Minister Jim Flaherty says that while there is a possibility of mistakes, the economic situation is urgent and the money needs to flow quickly.

The government says accountability measures it has adopted in recent years are strong enough to help ensure the money gets spent properly.

The government promised such an emergency fund in last month's federal budget, but its price tag and details were contained in the 2009-10 main estimates Toews tabled Thursday.

Posted by

Fillibluster

at

4:07 PM

1 comments

![]()

![]()

Flaherty admits to knowing from Charest, what Quebec voters were denied knowing?

Speaking to the issue of Caisse de depot's ABCP loss, Finance Minister Jim Flaherty stated:. "It was a very substantial loss. I have known for some time about the potential scale of the (Caisse's) loss. The good news is we were able to manage the asset-backed commercial paper issue - that was a primary issue for the Caisse. That was why the government of Canada went to the rescue of the asset-backed commercial paper issue. . . . Had we not done that, it would have been much worse." (National Post, February 25, 2009).

Hmmm? Charest claimed innocence about the looming losses during the recent Quebec election, hiding behind the shroud of the Caisse’s meager once a year reporting. One can only wonder how much Charest’s election timing was governed by this looming negative and highly political charged event would become , since the Caisse’s losses were already assured by its reckless foray into ABCP and exacerbated by the financial meldown that was well underway when Charest called his election.

So why did Jim Flaherty know something that Quebec voters were denied? Quebec voters only learned the truth yesterday, whereas Flaherty is proudly boasting that “I have known for some time”. How could he have known something for a long time that Charest said would only be known once the Caisse reports its year end numbers, which was only yesterday?

Do I detect a cover up on the part of Jean Charest and selective disclosure of critical financial information?

Posted by

Fillibluster

at

11:11 AM

6

comments

![]()

![]()

The simple fix for pensions is to cook their books, the way these three stooges cooked the books on tax leakage.

MP to look at state of Canadians' retirement

'A Sense Of Urgency'

Paul Vieira, Financial Post

Published: Wednesday, February 25, 2009

As civil servants work toward pushing fiscal stimuli quickly out the door and setting terms to make credit readily available, Conservative MP Ted Menzies is preparing to deal with another financial albatross -- the country's pension system.

Mr. Menzies is in charge of a one-month cross-country public consultation tour that kicks off next month in Ottawa and ends on April 17 in Winnipeg to look into federal laws governing private pension plans.

In an interview, Mr. Menzies, who serves as parliamentary secretary to Jim Flaherty, the Finance Minister, said time is of the essence -- and that's why he's aiming to have a final report ready -- with recommendations and potential legislative changes -- before Parliament returns in September after its summer break.

"To me this is very critical," said Mr. Menzies, who represents the rural southwestern Alberta riding of Macleod. "There is a sense of urgency. This impacts all Canadians.

"We need to figure out whether what we are doing today -- with either defined-benefit [DB] or defined-contribution [DC] -- is the right way to go," he said.

"Do we need to look at new options?"

Pension experts don't believe the current regime works. James Pierlot, a pension analyst at Towers Perrin in Toronto, said Canada's pensions are divided into three classes: the upper, in which mostly public servants and some private-sector employees have robust DB pensions; the middle, with some pension coverage but not enough to finance retirement; and the bottom, which the majority of Canadians belong to because they have no pension plan and little if any retirement savings.

"The consultation needs to look at who's got a plan and enough savings for retirement, and who doesn't -- and focus on that latter group and address how to deal with the needs of that constituency," Mr. Pierlot said yesterday.

Prior to announcing the Menziesled pension tour, the Department of Finance issued a request in early January for proposed changes to its nearly 25-year-old pension laws.

Among items that the department wanted feedback on include the pension-surplus threshold, which limits plan managers to surpluses of no more than 10% of assets, and whether alternative designs -- besides DC and DB -- should be allowed.

Even though the consultation is limited to federally regulated private pension plans, Mr. Menzies said changes his report recommends are likely to be adopted by the provinces.

The stock-market slump, sending North American benchmark indices to decade-long lows, brought immediate attention to pension funding. Ottawa moved to double the amount of time, to 10 years from five, pension managers had to pay down the unfunded liability, or the amount a plan would be short if all its members cashed out.

Mr. Pierlot added the consultation should also tackle income-tax measures that discourage retirement savings. The system is currently unfair, he argued in a recent paper for the C. D. Howe Institute, because rules limit annual contributions to retirement savings vehicles; unnecessarily tie pension savings to employment and employment income; restrict the kinds of income that can be used for retirement saving; and discourage the creation of the kind of large, pooled pension arrangements in the private sector that work well for public-sector workers.

William Robson, president of the C. D. Howe think-tank and one of the country's top pension analysts, said he gives the government credit for taking on this task and is encouraged there is a tight time frame. Ottawa last contemplated changes to pension rules in 2005, but that fell by the wayside.

He is also encouraged that Ottawa is willing to allow alternative pension schemes, outside of the standard DB and DC models.

"There is a tendency among policymakers to ignore the plight of the majority," Mr. Robson said, in reference to the self-employed and private-sector workers with no pension coverage.

Posted by

Fillibluster

at

9:00 AM

3

comments

![]()

![]()

Is it asking too much of Steve the Shyster, that we have intellectually rigorous tax policies?

Prove the case or drop the tax

Finance Minister Flaherty hasn't done his research on income trusts

Diane Francis,

Financial Post

January 24, 2007

The only fair resolution to the Tory income-trust mess is to compensate every investor who held onto, or bought, income trusts after Stephen Harper uncategorically promised they would remain untouched eight months ago.

That, or they must abandon their proposed tax on existing trusts.

The stupidity of this trust tax is why the issue hasn't and won't go away. It's why Opposition parties have correctly forced a hearing for next month at the finance committee in the House of Commons.

Personally, I am offended by the actions and attitude of rookie Finance Minister Jim Flaherty.

He was twice a rookie for: (a) not crafting an income-trust reform that would respect his Prime Minister's promise to leave existing income trusts alone; and (b) for not doing his homework in an area that he obviously doesn't understand - - thus the fact that he has parroted a number of obvious inaccuracies.

On the first gaffe, Mr. Flaherty should have known there were dozens of alternatives that would have stopped the proliferation of income trusts and, at the same time, surgically reformed existing ones without damaging investors. This is what the Americans and Australians did when they embarked on reforms.

But Mr. Flaherty did not do his research. He could not have because he said publicly that the Americans and Australians had shut down all their trusts except for real-estate ones. That's totally wrong.

The U.S. energy/infrastructure trust sector is now equivalent in size to 20% of the entire Toronto Stock Exchange, or more than US$480-billion. Whoops.

Then there's the tax leakage myth.

Department of Finance officials convinced, and gave Mr. Flaherty, the false information that registered retirement savings plans (RRSPs) and pension payments were tax-exempt. Too bad they aren't.

So the question that begs an answer is, why didn't this Finance Minister know this was untrue? Is it because he is not an investor and won't rely on his RRSP like 70% of Canadians must? Instead, he and his spouse are professional politicians with defined-benefit pension plans.

Another piece of "work" cited by government officials that tax leakage was an issue was done by Toronto academic Jack Mintz, who has been going around ever since distancing himself to paying customers on Bay Street from this research.

So there you have it: an academic allegedly unwilling to publicly come out defending or recanting as well as civil servants and a minister who apparently don't even understand how RRSPs or the tax system operates.

It's little wonder we have this mess -- which comes to my last, and possibly most important, point for the House of Commons committee members to consider and pursue.

About the only excuse I can think of to account for this $30- billion mistake is that securities laws prevented Flaherty from talking with knowledgeable industry sources ahead of time. There were leaks when the Liberals looked at income trusts and the Tories made an unholy fuss about that.

But that doesn't matter. Mr. Flaherty had plenty of experts to consult outside the Department of Finance, which has been gunning for this tax for ages.

If he wanted to understand the nature of RRSP and pension tax treatments, he could have called former finance minister Michael Wilson, who invented RRSPs in the 1980s

He is now on the government payroll as U.S. Ambassador and, therefore, securities law safe.

More important, Flaherty could have, and should have, picked up the phone and called the most knowledgeable man in the country -- Bank of Canada governor David Dodge.

If he did not do that, it's recklessness. If he did, and didn't listen, he was irresponsible. If he listened and rejected, then he had better tell the committee why the man who really runs the economy was wrong last summer when he defended income trusts after a bank study.

Here is what Dodge said in 2006:

"The work we have done in terms of capital markets, per se, is that probably, on balance, income trusts make capital markets somewhat more complete and somewhat more efficient," Dodge told a news conference held as part of the bank's quarterly economic outlook. The bank studied trusts.

"Limited evidence suggests that income trusts may enhance market completeness by providing diversification benefits to investors and a source of financing to firms that might not otherwise have had access to markets," the bank's study said.

That's why it is no wonder people who understand capital markets are furious.

Now, firms like PriceWaterhouseCoopers and various prestigious money-management firms are joined in the Canadian Association of Income Trust Investors.

And their bottom line is the same as mine. This Finance Minister must prove his case or drop the tax.

"If the government's actions cannot be fully substantiated by independent experts with proven expertise in the workings of the Canadian capital markets, then our Association will be calling for the repudiation of the Tax Fairness Plan in the name of fairness and good governance."

It all proves that being Finance Minister of Canada requires a lot more sophistication and a lot more experience than just paying bills, cutting costs and tinkering with local taxes as a provincial treasurer.

dfrancis@nationalpost.com

© 2008 The National Post Company. All rights reserved. Unauthorized distribution, transmission or republication strictly prohibited.

Posted by

Fillibluster

at

8:49 AM

1 comments

![]()

![]()

Wednesday, February 25, 2009

C D Howdy Doody think tank

C D Howe argues that Pension Funds be formally allowed to skirt rules, because they have been so successful in skirting rules?

The CD Howe Institute really has a knack for timing!

On a day that the Caisse lost $39 billion for reasons that Diane Francis described as “not having proper personnel or controls” and by making too many large bets, we have the CD Howe issuing a statement that the pension funds have devised elaborate schemes to skirt their own rules, and for this reason the rules should be abolished? Sheesh Am I missing something here?

Give Pension Funds Greater Voice; Scrap 30 percent Limit on Voting-Equity Stakes: C.D. Howe Institute

TORONTO, Feb. 25 /CNW/ - Regulators should eliminate the 30 percent rule that restricts pension funds from holding more than 30 percent of the voting equity in a corporation, according to a study released today by the C.D. Howe Institute. In A Matter of Voice: The Case for Abolishing the 30 percent Rule for Pension Fund Investments, law professor Poonam Puri points out that pension fund managers have devised elaborate ways to effectively skirt the rule. She makes the case that it is time for regulators to enforce the rule or eliminate it entirely and give pension funds a voice commensurate with their equity stake.

The author outlines three principle challenges to the 30 percent rule: 1) the rule is only subject to superficial compliance as regulators have allowed companies to work around the rule, resulting in unnecessary complexity and increased transaction costs; 2) since no other OECD jurisdiction has a similar rule, Canadian plans are at a disadvantage relative to foreign competitors when competing for a given investment; and 3) there are governance problems that result from disaggregating ownership from control.

Professor Puri explains the case for adopting prudent person standards, combined with appropriate guidance and direction to pension fund managers, in place of quantitative restrictions.

Posted by

Fillibluster

at

7:02 PM

1 comments

![]()

![]()

Caisse joins exclusive $30+ billion meltdown club, along with Manulife and income trust investors

Members include:

Caisse de depot: $39 billion caused by fund mismanagement, excessive exposure to the ABCP cheque kiting scheme...are these guys incompetent or what?

Manulife: $35 billion caused by management gamble to drive stock option gains, by issuing unhedged investment product....are these guys greedy or what?

Trust Investors: $35 billion caused by Harper’s drive by shooting, fraudulently alleging that income trusts cause tax leakage....are these people defrauded or what?

Just imagine how incensed the Caisse pensioners and Manulife shareholders would be, if their losses were sustained as a sole result of the Harper government, as was the case with income trusts investors.......would there be rioting in the streets yet?

Would Harper’s head be on the chopping block along with the CEOs of Manulife and the Caisse where it belongs?

Posted by

Fillibluster

at

4:50 PM

2

comments

![]()

![]()

Charest denounces Dumont.....and by extension, Harper

In a news interview today concerning the massive losses of Caisse de depot, Quebec Premier Jean Charest was asked by a reporter whether he would apologize to ADQ Leader Mario Dumont, in view of the fact that Mario Dumont had accurately warned voters during the election about the pending losses to their savings.

Charest refused to apologize to Dumont, saying that Dumont had fostered fear in the minds of seniors by meeting with them in seniors home and elsewhere to convey the pending bad news. Charest denounced such an approach......evidently on the basis that truth has no role in an election?

I guess the corollary to instilling fear in the minds of seniors for political gain during an election would be instilling false comfort in the minds of seniors for political gain during an election, as Stephen Harper did during the 2006 election campaign, and his promise to NEVER tax income trusts....the reneging of which caused losses equal to those sustained by the Caisse.

So whose conduct is more deserving of Charest’s disdain:

Mario Dumont for (accurately) warning Quebec seniors about the losses being sustained by the Caisse, or

Stephen Harper for (falsely) comforting Canadian seniors about the safety of their income trust investments......and subsequently falsifying his tax leakage analysis in an attempt to justify his policy betrayal flip flop.

Posted by

Fillibluster

at

2:55 PM

2

comments

![]()

![]()

Flaherty’s income trust tax carve-out for pension funds, insufficient to stem their massive losses.

How is it that income trusts cause tax leakage when held in an RRSP, but not when held in a pension fund? Otherwise why would Flaherty have allowed pension funds to own income trust and not pay the 31.5% tax?

Does that strike you as tax fairness? Of course not. Flaherty’s Tax Fairness Plan is actually a Tax Arbitrage Plan that Flaherty handed over to the pension funds so they could exploit on a predatory basis the income trusts held by the Average Joe and bolster their own under funded selves. What form of government sponsored highway robbery is that? The federal governments ripping off taxpayers to the sole advantage of the Provincial sponsored pension funds? Any wonder that all 10 provincial finance minister sent in letter of support for Flaherty’s idea of a tax fairness plan? On demand, as it were?

Meanwhile this rip off of income trusts investors by the provincial plans, all of whom exploited the tax arb handed to them by Flaherty, are reporting major losses. What other corrupt practices are going on within these funds vis-a-vis the Harper Government? Notice how vociferous these pension funds like Ontario Teachers were during the Goodale round and how totally passive and submissive and outright supportive they became during the Flaherty round? It’s called being “bought off” with a bespoke policy carve out.

The Liberals should be outraged, as they created the RRSP over 50 years ago with the sole policy intent of allowing the Average Joe to use an RRSP to replicate the benefits of those with pensions? That concept has been defiled by Flaherty. Where are the Liberals on this? In bed with the pension plans themselves?

Also, where is the Toronto Stock Exchange on this? Why would the TSX roll over in the face of a 31.5% tax that only applies to PUBLICLY LISTED income trusts and not those self-same trusts when held privately? Is the TSX actively trying to go out of business by losing listings and allowing a market that has represented 50% of new issue activity to die......based on the government’s demonstrable lie about tax leakage. It is all beginning to feel quite incestuous to me?

Quebec pension giant Caisse posts $39.8B loss (February 25, 2009)..... Caisse group to buy Legacy Hotels Income Fund for C$2.5 billion ( Jul 12, 2007)

OMERS books $8-billion 2008 investment loss (February 23, 2009) ....OMERS buys Teranet Income Fund for under $2 billion, cuts price (October 28, 2008)

Public Sector Pension Plan picks off Thunder Energy Trust for $4.00 per unit, even though it is exempt from new trust tax ( April 26th, 2007 )

Lots of other examples of the Tax Arbitrage Plan in action have occurred, that are too numerous to list.

Posted by

Fillibluster

at

12:16 PM

7

comments

![]()

![]()

Once upon a time, before hapless Harper, and his fraud known as tax leakage, there was the Energy Trust investment vehicle

Private sector investment in mining, energy to plummet

HEATHER SCOFFIELD

Wednesday, February 25, 2009

In its key annual survey of what businesses and governments plan to do with their money, Statscan showed that total investment in non-residential construction, machinery and equipment are expected to fall to $237.5-billion in 2009, down 6.6 per cent from 2008.

Public sector capital spending is poised to rise 9.5 per cent – as governments gear up huge stimulus packages to slow the recession – but that increase is more than wiped out by the scale-back in private-sector activity.

In particular, investment in mining, oil and gas is likely to plummet 26.4 per cent in 2009, taking its toll on the Alberta and British Columbia economies, Statscan said.

Excluding that sector, the decline in private-sector investment would have been cut in half.

While the survey of investment intentions is not a widely-watched indicator, it is an important piece of the puzzle to figuring out how Canada's economy will fare in the global crisis. Business investment creates employment, spurs confidence, and keeps the economy on its feet.

But the survey shows that business is taking a time out, ceding space to the public sector. The public sector share of total capital spending will climb from 28.6 per cent in 2008 to 33.5 per cent in 2009, if investment intentions pan out as expected.

That amount does not include the most recent announcements from the federal budget, since the survey was taken between October 2008 and January 2009, Statscan said. Still, most analysts and the Bank of Canada don't expect that federal spending to have much of an effect on the Canadian economy until next year.

The investment slowdown is most obvious in the oil sands sector, where companies have cancelled projects in line with a plunging oil price. Investment is expected to total $13.2-billion this year, down more than 30 per cent from last year.

Not surprisingly, manufacturing is also tightening its belt, with investment poised to decline 8.5 per cent to $18.4-billion. The biggest drop in spending intentions is in the wood products sector, where investment is expected to fall 28.8 per cent, followed by petroleum and coal products, and transportation equipment.

By region, Alberta and British Columbia will see the biggest drops, while Ontario and Quebec can expect the public sector to make up for most of the retrenchment of the private sector.

“There is nothing shocking in this report, since it was reasonable to expect a sharp reduction in investment spending this year as companies scale back production and mothball excess capacity,” commented economists at Scotia Capital Inc., adding that the survey has a “spotty record” of predicting actual investment outlays.

Still, Statistics Canada considers the survey to be central to understanding how the economy works, especially during a recession when business investment is crucial to the smooth functioning of the economy.

© The Globe and Mail

Posted by

Fillibluster

at

11:16 AM

1 comments

![]()

![]()

Recipe for Disaster: The [Canadian] Formula That Killed Wall Street

Recipe for Disaster: The Formula That Killed Wall Street

By Felix Salmon

02.23.09

WIRED Magazine

As Li himself said of his own model: "The most dangerous part is when people believe everything coming out of it."...........why I am I reminded about Mark Carney’s model of tax leakage....a model that has never seen the light of day? Some science that is, with no peer review? Some democracy that is, with no transparency? Whose purpose does that serve? Who is Mark Carney's sugar daddy? Canada is a country of compliant wimps. led to the slaughter by those in the media who are morally content to propagate known lies. They prefer the dark ages to the age of enlightenment.

In the mid-'80s, Wall Street turned to the quants—brainy financial engineers—to invent new ways to boost profits. Their methods for minting money worked brilliantly... until one of them devastated the global economy.

A year ago, it was hardly unthinkable that a math wizard like David X. Li might someday earn a Nobel Prize. After all, financial economists—even Wall Street quants—have received the Nobel in economics before, and Li's work on measuring risk has had more impact, more quickly, than previous Nobel Prize-winning contributions to the field. Today, though, as dazed bankers, politicians, regulators, and investors survey the wreckage of the biggest financial meltdown since the Great Depression, Li is probably thankful he still has a job in finance at all. Not that his achievement should be dismissed. He took a notoriously tough nut—determining correlation, or how seemingly disparate events are related—and cracked it wide open with a simple and elegant mathematical formula, one that would become ubiquitous in finance worldwide.

For five years, Li's formula, known as a Gaussian copula function, looked like an unambiguously positive breakthrough, a piece of financial technology that allowed hugely complex risks to be modeled with more ease and accuracy than ever before. With his brilliant spark of mathematical legerdemain, Li made it possible for traders to sell vast quantities of new securities, expanding financial markets to unimaginable levels.

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

David X. Li, it's safe to say, won't be getting that Nobel anytime soon. One result of the collapse has been the end of financial economics as something to be celebrated rather than feared. And Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees.

How could one formula pack such a devastating punch? The answer lies in the bond market, the multitrillion-dollar system that allows pension funds, insurance companies, and hedge funds to lend trillions of dollars to companies, countries, and home buyers.

A bond, of course, is just an IOU, a promise to pay back money with interest by certain dates. If a company—say, IBM—borrows money by issuing a bond, investors will look very closely over its accounts to make sure it has the wherewithal to repay them. The higher the perceived risk—and there's always some risk—the higher the interest rate the bond must carry.

Bond investors are very comfortable with the concept of probability. If there's a 1 percent chance of default but they get an extra two percentage points in interest, they're ahead of the game overall—like a casino, which is happy to lose big sums every so often in return for profits most of the time.

Bond investors also invest in pools of hundreds or even thousands of mortgages. The potential sums involved are staggering: Americans now owe more than $11 trillion on their homes. But mortgage pools are messier than most bonds. There's no guaranteed interest rate, since the amount of money homeowners collectively pay back every month is a function of how many have refinanced and how many have defaulted. There's certainly no fixed maturity date: Money shows up in irregular chunks as people pay down their mortgages at unpredictable times—for instance, when they decide to sell their house. And most problematic, there's no easy way to assign a single probability to the chance of default.

Wall Street solved many of these problems through a process called tranching, which divides a pool and allows for the creation of safe bonds with a risk-free triple-A credit rating. Investors in the first tranche, or slice, are first in line to be paid off. Those next in line might get only a double-A credit rating on their tranche of bonds but will be able to charge a higher interest rate for bearing the slightly higher chance of default. And so on.

"...correlation is charlatanism"

Photo: AP photo/Richard Drew

The reason that ratings agencies and investors felt so safe with the triple-A tranches was that they believed there was no way hundreds of homeowners would all default on their loans at the same time. One person might lose his job, another might fall ill. But those are individual calamities that don't affect the mortgage pool much as a whole: Everybody else is still making their payments on time.

But not all calamities are individual, and tranching still hadn't solved all the problems of mortgage-pool risk. Some things, like falling house prices, affect a large number of people at once. If home values in your neighborhood decline and you lose some of your equity, there's a good chance your neighbors will lose theirs as well. If, as a result, you default on your mortgage, there's a higher probability they will default, too. That's called correlation—the degree to which one variable moves in line with another—and measuring it is an important part of determining how risky mortgage bonds are.

Investors like risk, as long as they can price it. What they hate is uncertainty—not knowing how big the risk is. As a result, bond investors and mortgage lenders desperately want to be able to measure, model, and price correlation. Before quantitative models came along, the only time investors were comfortable putting their money in mortgage pools was when there was no risk whatsoever—in other words, when the bonds were guaranteed implicitly by the federal government through Fannie Mae or Freddie Mac.

Yet during the '90s, as global markets expanded, there were trillions of new dollars waiting to be put to use lending to borrowers around the world—not just mortgage seekers but also corporations and car buyers and anybody running a balance on their credit card—if only investors could put a number on the correlations between them. The problem is excruciatingly hard, especially when you're talking about thousands of moving parts. Whoever solved it would earn the eternal gratitude of Wall Street and quite possibly the attention of the Nobel committee as well.

To understand the mathematics of correlation better, consider something simple, like a kid in an elementary school: Let's call her Alice. The probability that her parents will get divorced this year is about 5 percent, the risk of her getting head lice is about 5 percent, the chance of her seeing a teacher slip on a banana peel is about 5 percent, and the likelihood of her winning the class spelling bee is about 5 percent. If investors were trading securities based on the chances of those things happening only to Alice, they would all trade at more or less the same price.

But something important happens when we start looking at two kids rather than one—not just Alice but also the girl she sits next to, Britney. If Britney's parents get divorced, what are the chances that Alice's parents will get divorced, too? Still about 5 percent: The correlation there is close to zero. But if Britney gets head lice, the chance that Alice will get head lice is much higher, about 50 percent—which means the correlation is probably up in the 0.5 range. If Britney sees a teacher slip on a banana peel, what is the chance that Alice will see it, too? Very high indeed, since they sit next to each other: It could be as much as 95 percent, which means the correlation is close to 1. And if Britney wins the class spelling bee, the chance of Alice winning it is zero, which means the correlation is negative: -1.

If investors were trading securities based on the chances of these things happening to both Alice and Britney, the prices would be all over the place, because the correlations vary so much.

But it's a very inexact science. Just measuring those initial 5 percent probabilities involves collecting lots of disparate data points and subjecting them to all manner of statistical and error analysis. Trying to assess the conditional probabilities—the chance that Alice will get head lice if Britney gets head lice—is an order of magnitude harder, since those data points are much rarer. As a result of the scarcity of historical data, the errors there are likely to be much greater.

In the world of mortgages, it's harder still. What is the chance that any given home will decline in value? You can look at the past history of housing prices to give you an idea, but surely the nation's macroeconomic situation also plays an important role. And what is the chance that if a home in one state falls in value, a similar home in another state will fall in value as well?

Here's what killed your 401(k) David X. Li's Gaussian copula function as first published in 2000. Investors exploited it as a quick—and fatally flawed—way to assess risk. A shorter version appears on this month's cover of Wi

Enter Li, a star mathematician who grew up in rural China in the 1960s. He excelled in school and eventually got a master's degree in economics from Nankai University before leaving the country to get an MBA from Laval University in Quebec. That was followed by two more degrees: a master's in actuarial science and a PhD in statistics, both from Ontario's University of Waterloo. In 1997 he landed at Canadian Imperial Bank of Commerce, where his financial career began in earnest; he later moved to Barclays Capital and by 2004 was charged with rebuilding its quantitative analytics team.

Li's trajectory is typical of the quant era, which began in the mid-1980s. Academia could never compete with the enormous salaries that banks and hedge funds were offering. At the same time, legions of math and physics PhDs were required to create, price, and arbitrage Wall Street's ever more complex investment structures.

In 2000, while working at JPMorgan Chase, Li published a paper in The Journal of Fixed Income titled "On Default Correlation: A Copula Function Approach." (In statistics, a copula is used to couple the behavior of two or more variables.) Using some relatively simple math—by Wall Street standards, anyway—Li came up with an ingenious way to model default correlation without even looking at historical default data. Instead, he used market data about the prices of instruments known as credit default swaps.

If you're an investor, you have a choice these days: You can either lend directly to borrowers or sell investors credit default swaps, insurance against those same borrowers defaulting. Either way, you get a regular income stream—interest payments or insurance payments—and either way, if the borrower defaults, you lose a lot of money. The returns on both strategies are nearly identical, but because an unlimited number of credit default swaps can be sold against each borrower, the supply of swaps isn't constrained the way the supply of bonds is, so the CDS market managed to grow extremely rapidly. Though credit default swaps were relatively new when Li's paper came out, they soon became a bigger and more liquid market than the bonds on which they were based.

When the price of a credit default swap goes up, that indicates that default risk has risen. Li's breakthrough was that instead of waiting to assemble enough historical data about actual defaults, which are rare in the real world, he used historical prices from the CDS market. It's hard to build a historical model to predict Alice's or Britney's behavior, but anybody could see whether the price of credit default swaps on Britney tended to move in the same direction as that on Alice. If it did, then there was a strong correlation between Alice's and Britney's default risks, as priced by the market. Li wrote a model that used price rather than real-world default data as a shortcut (making an implicit assumption that financial markets in general, and CDS markets in particular, can price default risk correctly).

It was a brilliant simplification of an intractable problem. And Li didn't just radically dumb down the difficulty of working out correlations; he decided not to even bother trying to map and calculate all the nearly infinite relationships between the various loans that made up a pool. What happens when the number of pool members increases or when you mix negative correlations with positive ones? Never mind all that, he said. The only thing that matters is the final correlation number—one clean, simple, all-sufficient figure that sums up everything.

The effect on the securitization market was electric. Armed with Li's formula, Wall Street's quants saw a new world of possibilities. And the first thing they did was start creating a huge number of brand-new triple-A securities. Using Li's copula approach meant that ratings agencies like Moody's—or anybody wanting to model the risk of a tranche—no longer needed to puzzle over the underlying securities. All they needed was that correlation number, and out would come a rating telling them how safe or risky the tranche was.

As a result, just about anything could be bundled and turned into a triple-A bond—corporate bonds, bank loans, mortgage-backed securities, whatever you liked. The consequent pools were often known as collateralized debt obligations, or CDOs. You could tranche that pool and create a triple-A security even if none of the components were themselves triple-A. You could even take lower-rated tranches of other CDOs, put them in a pool, and tranche them—an instrument known as a CDO-squared, which at that point was so far removed from any actual underlying bond or loan or mortgage that no one really had a clue what it included. But it didn't matter. All you needed was Li's copula function.

The CDS and CDO markets grew together, feeding on each other. At the end of 2001, there was $920 billion in credit default swaps outstanding. By the end of 2007, that number had skyrocketed to more than $62 trillion. The CDO market, which stood at $275 billion in 2000, grew to $4.7 trillion by 2006.

At the heart of it all was Li's formula. When you talk to market participants, they use words like beautiful, simple, and, most commonly, tractable. It could be applied anywhere, for anything, and was quickly adopted not only by banks packaging new bonds but also by traders and hedge funds dreaming up complex trades between those bonds.

"The corporate CDO world relied almost exclusively on this copula-based correlation model," says Darrell Duffie, a Stanford University finance professor who served on Moody's Academic Advisory Research Committee. The Gaussian copula soon became such a universally accepted part of the world's financial vocabulary that brokers started quoting prices for bond tranches based on their correlations. "Correlation trading has spread through the psyche of the financial markets like a highly infectious thought virus," wrote derivatives guru Janet Tavakoli in 2006.

The damage was foreseeable and, in fact, foreseen. In 1998, before Li had even invented his copula function, Paul Wilmott wrote that "the correlations between financial quantities are notoriously unstable." Wilmott, a quantitative-finance consultant and lecturer, argued that no theory should be built on such unpredictable parameters. And he wasn't alone. During the boom years, everybody could reel off reasons why the Gaussian copula function wasn't perfect. Li's approach made no allowance for unpredictability: It assumed that correlation was a constant rather than something mercurial. Investment banks would regularly phone Stanford's Duffie and ask him to come in and talk to them about exactly what Li's copula was. Every time, he would warn them that it was not suitable for use in risk management or valuation.

In hindsight, ignoring those warnings looks foolhardy. But at the time, it was easy. Banks dismissed them, partly because the managers empowered to apply the brakes didn't understand the arguments between various arms of the quant universe. Besides, they were making too much money to stop.

In finance, you can never reduce risk outright; you can only try to set up a market in which people who don't want risk sell it to those who do. But in the CDO market, people used the Gaussian copula model to convince themselves they didn't have any risk at all, when in fact they just didn't have any risk 99 percent of the time. The other 1 percent of the time they blew up. Those explosions may have been rare, but they could destroy all previous gains, and then some.

Li's copula function was used to price hundreds of billions of dollars' worth of CDOs filled with mortgages. And because the copula function used CDS prices to calculate correlation, it was forced to confine itself to looking at the period of time when those credit default swaps had been in existence: less than a decade, a period when house prices soared. Naturally, default correlations were very low in those years. But when the mortgage boom ended abruptly and home values started falling across the country, correlations soared.

Bankers securitizing mortgages knew that their models were highly sensitive to house-price appreciation. If it ever turned negative on a national scale, a lot of bonds that had been rated triple-A, or risk-free, by copula-powered computer models would blow up. But no one was willing to stop the creation of CDOs, and the big investment banks happily kept on building more, drawing their correlation data from a period when real estate only went up.

"Everyone was pinning their hopes on house prices continuing to rise," says Kai Gilkes of the credit research firm CreditSights, who spent 10 years working at ratings agencies. "When they stopped rising, pretty much everyone was caught on the wrong side, because the sensitivity to house prices was huge. And there was just no getting around it. Why didn't rating agencies build in some cushion for this sensitivity to a house-price-depreciation scenario? Because if they had, they would have never rated a single mortgage-backed CDO."

Bankers should have noted that very small changes in their underlying assumptions could result in very large changes in the correlation number. They also should have noticed that the results they were seeing were much less volatile than they should have been—which implied that the risk was being moved elsewhere. Where had the risk gone?

They didn't know, or didn't ask. One reason was that the outputs came from "black box" computer models and were hard to subject to a commonsense smell test. Another was that the quants, who should have been more aware of the copula's weaknesses, weren't the ones making the big asset-allocation decisions. Their managers, who made the actual calls, lacked the math skills to understand what the models were doing or how they worked. They could, however, understand something as simple as a single correlation number. That was the problem.

"The relationship between two assets can never be captured by a single scalar quantity," Wilmott says. For instance, consider the share prices of two sneaker manufacturers: When the market for sneakers is growing, both companies do well and the correlation between them is high. But when one company gets a lot of celebrity endorsements and starts stealing market share from the other, the stock prices diverge and the correlation between them turns negative. And when the nation morphs into a land of flip-flop-wearing couch potatoes, both companies decline and the correlation becomes positive again. It's impossible to sum up such a history in one correlation number, but CDOs were invariably sold on the premise that correlation was more of a constant than a variable.

No one knew all of this better than David X. Li: "Very few people understand the essence of the model," he told The Wall Street Journal way back in fall 2005.

"Li can't be blamed," says Gilkes of CreditSights. After all, he just invented the model. Instead, we should blame the bankers who misinterpreted it. And even then, the real danger was created not because any given trader adopted it but because every trader did. In financial markets, everybody doing the same thing is the classic recipe for a bubble and inevitable bust.

Nassim Nicholas Taleb, hedge fund manager and author of The Black Swan, is particularly harsh when it comes to the copula. "People got very excited about the Gaussian copula because of its mathematical elegance, but the thing never worked," he says. "Co-association between securities is not measurable using correlation," because past history can never prepare you for that one day when everything goes south. "Anything that relies on correlation is charlatanism."

Li has been notably absent from the current debate over the causes of the crash. In fact, he is no longer even in the US. Last year, he moved to Beijing to head up the risk-management department of China International Capital Corporation. In a recent conversation, he seemed reluctant to discuss his paper and said he couldn't talk without permission from the PR department. In response to a subsequent request, CICC's press office sent an email saying that Li was no longer doing the kind of work he did in his previous job and, therefore, would not be speaking to the media.

In the world of finance, too many quants see only the numbers before them and forget about the concrete reality the figures are supposed to represent. They think they can model just a few years' worth of data and come up with probabilities for things that may happen only once every 10,000 years. Then people invest on the basis of those probabilities, without stopping to wonder whether the numbers make any sense at all.

As Li himself said of his own model: "The most dangerous part is when people believe everything coming out of it."

Posted by

Fillibluster

at

9:27 AM

1 comments

![]()

![]()

Tuesday, February 24, 2009

Apparently Harper is sucking and blowing on the Stimulus

Today on POLITICS with Don Newman we learn from Don’s pundit guest from Calgary, that Stephen Harper in his private meetings in New York yesterday was espousing the view that “ we are going overboard with stimulus in North America”.

Well what kind of sucking and bkowing leadership is that? Harper is trying to ride both horses at once. For public consumption in Canada, we are lead to believe that Harper’s heart in this stimulus, but for private consumption in the the US, he is disowning it?

What does this imply about whether these stimulus tax dollars are actually going to be spent. What does this imply about Harper’s integrity and plausibility?

Does Harper believe in the actions of his government or does he not? None of this sucking and blowing can remotely be considered "leadership", for those who may have delusions that Harper is a leader.

Posted by

Fillibluster

at

6:03 PM

3

comments

![]()

![]()

The Big Global Screw-up

At first I thought this article was an article about the pending bankruptcy of Canwest Global, but to my amazement it was an article by Terry Corcoran preaching about policy makers owning up to their mistakes. And yet here at home we witnessed Terry Corcoran running a major PR offensive on behalf of Stephen Harper and Jim Flaherty in their income trust tax leakage fraud/cover up, that caused the loss of $35 billion in Canadians’ savings.

I don’t get it? Terry Corcoran preaches about the need for politicians to admit to their “regulatory and policy failure on a global scale”, while at the same time he spends his time running cover for the demonstrable lies of Canada’s Prime Minister and Finance Minister, and condemns anyone who dares to stand for truth about tax leakage. Ditto for Eric Reguly at the Globe and Mail. According to these thug journalists, Canadians who seek the truth from their elected government are to either be vaporized or encased in concrete and thrown into the nearest lake.

Truth be told, this Big Global Screw-up was aided and abetted by the very sycophants like Terry Corcoran who muster their courage to speak up when conditions are both (1) safe and (2) brain dead obvious. Terry Corcoran’s moral authority to speak on issues such as these, is non-existent.

Posted by

Fillibluster

at

3:29 PM

3

comments

![]()

![]()

In the name of Air Canada, West Jet and Porter Airlines

Harper won't support high speed rail link between Que. and Ont.: McGuinty

February 24, 2009

Maria Babbage

THE CANADIAN PRESS

Prime Minister Stephen Harper is frowning on a proposal for a high-speed rail link between Ontario and Quebec that would boost the economy and help the environment, Premier Dalton McGuinty said today.

Without federal support, the proposed link between Windsor, Ont., and Quebec City may never get off the ground, McGuinty said.

"I continue to be a big fan of (the plan), as does (Quebec Premier) Jean Charest," McGuinty said.

"The prime minister is not as much of a fan on this score."

McGuinty didn't say what objections Harper may have to the proposal, which has floated around for more than a decade.

There are plenty of reasons why it should go ahead, McGuinty said.

"I like it because it fights climate change, it fights traffic congestion – so it enhances our productivity levels – it creates jobs, and it enhances our quality of life," he said.

Experts have advised the province to do a better job of connecting big communities to build a strong economy, he added.

"It does all those things, which is why I think it's a worthwhile project."

The federal government has said in the past that Canada wasn't yet ready for high-speed trains.

While they may not see eye-to-eye on the project, the three governments are jointly spending $3 million for another feasibility study.

The new study, awarded to the EcoTrain Consortium, will examine the cost and environmental impact of the project, as well as the level of demand for the service, the Ontario government said in a release Monday.

The report will also update information that was previously gathered in earlier studies, it said.

Posted by

Fillibluster

at

3:10 PM

3

comments

![]()

![]()

Manulife loses $35 billion in value, equal to the loss it helped inflict on trust investors

Today we learn that Manulife has lost some 70% of its value since September 15 of this year, an amount equal to $35 billion, which is exactly the amount of money that income trust investors lost from Jim Flaherty’s reckless policy to destroy income trusts. That’s , however where the similarities end. You see, Manulife’s losses occurred because of the global meltdown in stock values. However Manulife was more acutely affected than others for reasons solely of its own creation and mismanagement, whereas income trusts investors lost their $35 billion solely as a result of the Harper government's action and the policy lies that were advanced by Jim Flaherty and Mark Carney that income trusts cause tax leakage.

Manulife was one of the groups who benefited most (in the short term) from the government’s actions to kill income trusts. This is why Manulife’s CEO was only too happy to provide testimony in favour of the government’s action to kill income trusts. Much like the child running a lemonade stand on one side of the street would love it if someone (the government?) would close the competing lemonade stand on the opposite side of the street to boost his sales, Manulife and others in the insurance industry went running to the government to kill the competing investment product called income trusts. They coined the resulting exercise as one of “leveling the playing field”, except that actually meant removing the opposing team from the field as the means for "fair play"? For this they relied on the Harper government, who in turn advanced a host of patently false arguments to advance that cause and to defraud 2.5 million Canadians taxpayers of $35 billion of their wealth. While bringing about a host of other adverse consequences.

In fact one of those adverse consequences has come to haunt Manulife itself, who had sought to boost the sales of its variable rate annuity business and other lines of business by killing income trusts. They were successful in doing so, however greed got the better of them as they decided arbitrarily to cease hedging the risks that this new book of business represented to their balance sheet. This was done for the sole reason of boosting (some would say artificially) Manulife’s earnings per share, which in turn would maximize the value of management’s stock options. Unfortunately for Manulife’s management, things didn’t work out quite as planned. Turns out they aren’t the masters of the universe they think they are. They were smart enough to dupe the Harper government into killing income trusts, but they weren’t smart enough to realize the house of cards they had built for themselves and the undue risks they were taking in their gamble on annuities providing guaranteed investment returns.

Manulife’s solution in recovering $35 billion of lost value is a lot tougher, as it should be, than it is for income trust investors. We simply need to lift the veil on the lies of the Stephen Harper government as it pertains to his fraudulent claims of tax leakage and ensure that the Liberal party remain true to their word to rescind this absurd and self destructive income trust tax.

Good luck Dominic. Even your in-house newspaper, the Globe and Mail, is saying that its time for you to confront reality.. The one of your own creation, as distinct from the fabrications foisted on income trust investors by the Harper government.

Posted by

Fillibluster

at

8:14 AM

5

comments

![]()

![]()

Stephen Harper does his thing to boost Canadian productivity and reduce global warming?

The photo op took the train out of service for a day, because Mr. Harper insisted the locomotive should face west. “Normally all our locomotives are east-facing,” a GO staffer told me. GO took it over to the VIA yards to turn it around, and then turned it back around after the PM departed.

Posted by

Fillibluster

at

7:23 AM

3

comments

![]()

![]()

Monday, February 23, 2009

Shamelessly, Harper is appropriating Paul Martin’s legacy

PM praises Canada's financial sector on U.S. TV

Feb 23, 2009 12:53 PM

Toronto Star

OTTAWA — Prime Minister Stephen Harper hit the Big Apple today — the heart of America's economic meltdown — to boast about Canada's stable banking system, warn against trade protectionism and note the insatiable appetite for oil south of the border.

Left to their own devices, Canadian banks would have blown up too, had Paul Martin not realized that consolidating risk into fewer hands may have short term gains, but long term pains. Which is why he wasn't pumping the happy gas of this announced deal and prevented it from occurring:

Bank of Montreal and Royal Bank to merge

November 13, 1998

CBC News

The Bank of Montreal and the Royal Bank of Canada have announced plans to merge. If the agreement gets regulatory approval, it will be by far the largest bank in Canada and will be in the top ten in North America.

Royal Chairman John Cleghorn says it's potentially one of the most memorable days in the history of banking.

The Royal Bank is Canada's largest, the Bank of Montreal is number three on the list. The merger means the combined bank will have over 80,000 employees. It would have assets of more than $450 billion.

The merger may not happen as quickly as the banks would like. It requires federal approval and the finance minister says that won't happen soon. Paul Martin says he won't give approval until a task force on banking completes its report in a few months.

Observers suggest the merger will mean a significant loss of jobs. The banks say that won't happen. They say early retirements, voluntary departures and job retraining will help reduce the number of employees.

The buzz word for the merger is that size matters. The two organizations says they will prosper because of the new size and the economies of scale.

Immediately after the merger was announced there was a rush of trading on the Toronto Stock Exchange. Shares in Canada's banks were up significantly.

Posted by

Fillibluster

at

8:38 PM

2

comments

![]()

![]()

An essential prerequisite to any auto bailout

The term “legacy costs” has been conveniently redefined of late, to include the massive underfunding of pensions facing GM and Chrysler. This change is terminology is designed to present something that is intolerable to most Canadians, namely a pension bailout, in a more palatable form using more reassuring language. Even if the bailout money is ostensibly intended for the bailout of things other than pensions, it will invariably be devoted to the bailout of pensions, given that money is fungible and the pension obligation is contractual.

Recognizing that structural changes must be made to achieve viability for the North American auto industry and given GM has proven that the economics of the auto industry are such that pensions are a luxury and employee benefit that it has proven itself unable to be afforded nor sustained, then this benefit needs to be terminated.

As such, a prerequisite of any auto bailout by the Canadian government should be a cessation of this employee benefit. All existing entitlements to pensions earned to date by existing employees and retired employees should be respected in full, on an as earned basis. However no further pension obligations will be earned or accrued from the bailout date forward. Under such an arrangement, the economic viability of the auto sector will be enhanced and the auto assembly workers will become one with the 75% of Canadians, and car-buying tax-paying public, who are without pensions themselves.

Who knows, Manulife might even be able to sell some more Income Plus, and the CAW might actually garner a better sense for what it meant when Flaherty began taxing income trusts at a combined tax rate of 64%. Jim Stanford of the CAW could perhaps do some homework on the topic before blindly supporting Flaherty’s actions, as he did, and learn that tax leakage is a total fabricated hoax. Jim Stanford needn’t even lift a finger, as all the work has been done, by groups far more credible than the CAW has proven itself to be on matters far beyond its purview.

While on the subject of legacy costs for the auto companies, such as health care, I am wondering where in the supposed proportionate bailout of GM, as between the US and Canada, is the cost that is incurred by Canadian taxpayers in the provision of universal healthcare being reflected in the negotiations, as to the proportionate obligations of the US and Canadian government, given that no such tax payer subsidy exists insofar as the US workers are concerned? This is hardly chump change. Please assure me as that taxpayer, that this important distinction has not been overlooked.

Posted by

Fillibluster

at

8:01 PM

1 comments

![]()

![]()

The evolution of Harper's economic excuses

According the Harper, we have gone from being immune from US economic woes during the election, to now, being solely dependent on their recovery? Do I detect a lack of leadership and a disowning of responsibility? Or just a hack economist on the make?

No U.S. financial fix, no recession end - Canada PM Harper

Mon Feb 23, 2009

OTTAWA, Feb 23 (Reuters) - Canadian Prime Minister Stephen Harper, voicing deep concern about the financial system in the United States and other countries, said on Monday he could not see how the current recession can end until they are fixed.

"We're obviously all hugely worried about the American financial system and about the financial system of some other countries," the Conservative leader said in an interview in New York with Fox News.

"Frankly...until that problem gets fixed, it's hard for me to see how we're going to turn the corner on this recession that we're in now."

He also said Canada did not have the same financial sector problems as in the United States.

"We haven't had to bail out any of our financial institutions. We don't have the mortgage problem. Certainly, we have a downturn in our housing sector, but it's not structural. There will be no government bailout of mortgages in Canada," he said.

One of the strengths of Canada's financial system, he said, is its compactness, with just six major banks and three major insurance companies.

"So it's easier for the government to exercise moral suasion on the sector," he said, noting that the government superintendent of financial institutions meets regularly with those institutions.

Harper also said the Canadian government, which had run surpluses for more than a decade until this year, should be able to return to budget surplus in about four years. (Reporting by Randall Palmer; Editing by Peter Galloway)

Posted by

Fillibluster

at

7:09 PM

3

comments

![]()

![]()

NDP MP Comartin looks at ways to help author Zytaruk sue Conservatives

My suggestion is that monies raised from concerned Canadians who are interested in preserving the integrity of our democracy be collected and used to defend Zytaruk against Harper’s slander and libel , and in turn would be repaid with the proceeds from the sale of a new book to be written by Zytrauk on the entire trial/ordeal.

The proceeds from the book would first go to pay off those who contributed to his legal defense and any excess would accrue to Zytrauk, 100%.

I am good for the first $1,000 and could be talked into more. What say you?

To expedite matters and to defray costs, we would retain the services of the Liberal’s former lawyer and leverage off the the fine legal work he has done to date.

NDP MP Comartin looks at ways to help author Zytaruk sue Conservatives:

NDP MP Joe Comartin says Conservatives must stop 'really ridiculous position' and false accusations against Tom Zytaruk.

By Harris MacLeod

The Hill Times

NDP MP Joe Comartin says he is looking at ways to help author Tom Zytaruk finance a lawsuit against the governing Conservatives.

Mr. Zytaruk's book Like A Rock: The Chuck Cadman Story prompted sensational Liberal allegations last year of bribery against the Prime Minister who in turn launched an unprecedented $3.5-million defamation lawsuit against the Grits. But the Prime Minister suddenly dropped his lawsuit earlier this month and the Conservatives and Liberals agreed not to talk about the settlement.

But Mr. Comartin (Windsor-Tecumseh, Ont.) said Mr. Zytaruk sent him an email last week thanking him for defending him against more recent Conservative attacks in the House of Commons and for going after Conservative MP Pierre Poilievre (Nepean-Carleton, Ont.) in Question Period after Mr. Poilievre, who is Prime Minister Stephen Harper's (Calgary Southwest, Alta.) Parliamentary secretary, repeated the sensational allegation that Mr. Zytaruk doctored a taped interview he had with Mr. Harper in 2005 which was part of the book.