By Stuart Thomson

The Whitecourt Star

Journalists, politicians, and communications people all have a common fascination with information.

For all the talk of Stephen Harper's controlling ways, you only have to look back a few years to see that Jean Chretien did the exact same thing. I think they both tried desperately to control information, both in and out of their government, most of the time successfully.

When Harper boasted to Peter Mansbridge last week that his government had gone five years without any scandals, he was correct. It probably has a lot to do with the tight reigns he holds on information, especially when it comes to the government's sprawling stimulus program.

Journalists have access to information laws on their side, but they don't always work as they're supposed to.

It seems obvious to me that information should belong to the taxpayer by default. The burden should be on the government to prove why certain things shouldn't be released, rather than the other way around.

Advice to cabinet ministers is not released, which makes sense. You want advisors to feel empowered to offer bold suggestions without fear of it being released.

Advertisement

Personal information is generally held back and this one is obvious.

Any requests about the Economic Action Plan seemed to get stalled interminably, and data about the costs of individual projects and geographical points were never allowed to intersect. It was very hard to figure out where all the money was going. That information is too powerful for taxpayers to know, apparently.

A wise person once told me, though, that a bureaucrat is never going to be condemned by his bosses for not releasing enough information. It's an unfortunate fact, and anyone requesting information at the federal level will have experienced this.

Once again, the benefits of a small town become clear, even on issues like this. I've been looking for information on collisions in the area since I moved here. It's just one of those interesting little data snacks that tells you a lot about a town or a county.

Now, requesting a similar kind of document at the federal level would probably take a few months, a few testy conversations with data coordinators and bureaucrats, and eventually a file that doesn't even contain what I was asking for in the first place.

In a Town? Well, you simply ask someone at a committee and then it shows up in your inbox in less than a week.

Just that little bit of easy-going transparency is a very good thing for a government, at any level, to make a habit.

And it may be true that, at the federal level, the more you keep from the taxpayers the less likely to feel a scandal rumbling beneath your government but I would suggest that maybe it's smarter just to avoid scandalous activity in the first place. Then you don't have to worry about hiding it.

People are entitled to the information that is collected and generated by their tax dollars and it's nice to see some folks, at the Town of Whitecourt, agree.

Thursday, January 27, 2011

Government data belongs to taxpayers

Posted by

Brent Fullard

at

1:04 PM

4

comments

![]()

![]()

Tuesday, January 25, 2011

Globe: Trust tax tilts the balance to foreign takeovers

Boyd Erman in today’s Globe writes:

"Houston-based Magnum is buying NuLoch Resources for $327-million, in a deal announced last week. Since then, some bankers report heightened interest from more mid-tier American buyers.

One perceived advantage for American oil and gas companies looking at buying in Canada is that they can get more leverage than Canadian acquirers, giving them a cost of capital advantage. American banks are willing to lend smaller oil companies more, with as much as twice as much debt per dollar of cash flow on offer. They also have access to more financing in other areas of the capital structure such as bond debt and preferred shares, bankers say.

The disappearance of the trust structure, which allowed many Canadian producers to trade at high multiples, is also tilting the balance back toward American buyers."

Posted by

Brent Fullard

at

10:14 AM

12

comments

![]()

![]()

Tuesday, January 18, 2011

Two CEOs slam Flaherty’s trust decision as a blunder and a mistake

Today BNN spoke with Rebecca Macdonald, CEO of Just Energy Trust, and Don Gray, CEO of Peyto Energy Trust about Flaherty’s trust decision:

See the 7:00 mark here

Posted by

Brent Fullard

at

7:13 PM

12

comments

![]()

![]()

Monday, January 10, 2011

Freedom FROM information

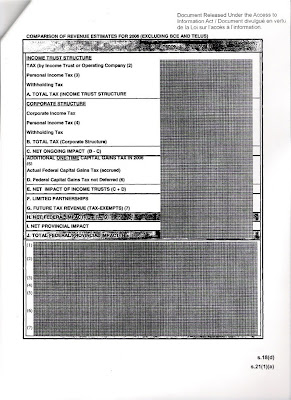

Image: One of the recalled documents that Flaherty did not want to be in the hands of Canadians. Click on image to enlarge

Too much information in the hands of the people is a dangerous thing....even blacked out documents. The Liberals could have had a field day over this, but did not. Why not?

Ottawa seeks return of trust tax documents

STEVEN CHASE

Globe and Mail

April 20, 2007

OTTAWA — The Harper government is asking a Calgary income trust analyst to give back heavily censored documents Ottawa sent him that detail calculations used to justify last fall's controversial trust tax.

Warning that its lawyers have decided the information is top secret, Ottawa is also requesting that BMO Nesbitt Burns analyst Gordon Tait stop sharing this information with other Canadians.

It's hard to see how Ottawa benefits from recouping the documents, which summarize how it calculated that trusts are costing it hundreds of millions of dollars in annual lost tax revenue.

That's because nearly half of them are blacked out by a federal Finance Department censor's pen.

Related to this article

Mr. Tait made news headlines this year after he requested details from Finance Minister Jim Flaherty's department on how it determined that trusts were a drain on federal coffers.

In response, Finance sent him 28 pages, 13 of which were heavily blacked out. These appeared to detail the calculations and methodology used.

Now the Finance Department wants about 18 of those pages back.

“Subsequent to the Department of Finance's ... release of information to you, the Privy Council Office Counsel has confirmed that portions of the released information, namely 1-5 and 9-21, are confidences of the Queen's Privy Council for Canada,” a Finance official wrote in a letter to Mr. Tait this week.

“We would like to ask for your assistance in returning these pages and also that this information not be disseminated further.”

The letter has left Mr. Tait scratching his head because he and other trust advocates have already widely circulated the heavily excised documents.

“It's a bizarre situation. They're trying to put the toothpaste back into the tube,” he said, adding that he's learned that other Canadians are receiving similar letters asking them to relinquish documents.

Mr. Tait said he will return the original documents, but will warn Ottawa that “I and thousands of others have copies of this.”

He said most of the pages that Ottawa wants returned are heavily censored. “It's a request for information that was never divulged in the first place,” Mr. Tait said, however adding that the largely blacked-out pages nevertheless reveal some details of the methodology used in calculations.

The Finance Department did not immediately return phone calls.

Tax revenue losses were central to Mr. Flaherty's rationale for breaking a Conservative election promise and slapping a levy on trusts.

He justified the new levy last Halloween by saying that annual tax leakage was already $500-million and would have risen to $800-million had BCE Inc. and Telus Corp. converted to trusts.

Income trusts pay little or no corporate tax, instead shovelling out the bulk of earnings to investors, who are taxed individually. Ottawa says it never recoups all the tax these businesses would have paid had they been structured as corporations instead of trusts.

Trusts have produced experts to counter Ottawa's tax leakage estimates, but Mr. Flaherty has steadfastly defended his department's calculations, which suggested losses for the federal government and provinces could exceed $1-billion.

The Finance Minister had also warned that tax revenue hemorrhaging would only grow if left unchecked until it threatened the federal government's ability to fund priorities such as health care, education and infrastructure.

Posted by

Brent Fullard

at

9:19 AM

6

comments

![]()

![]()

Sunday, January 9, 2011

Why it makes sense for Liberals to attack Jim Flaherty

Globe and Mail Article of the same title here

My posted comment here:

Scott Brison failed to mention the $35 billion of Canadians' retirement savings that Jim Flaherty destroyed with his income trust tax that was predicated on the complete hoax argument of "tax leakage". The only tax leakage from income trusts was the one created by Jim Flaherty himself from the wave of takeovers of vulnerable and devalued trusts by foreigners who pay NO taxes, like the $5 billion takeover of Prime West Energy trust by Abu Dhabi Energy, to name but one of the 45 takeovers. Flaherty is inept and incompetent in the extreme, not to mention completely lacking in integrity.

Posted by

Brent Fullard

at

11:21 PM

4

comments

![]()

![]()

"Canadians must trust" Stephen Harper in emails to trust investors November 21, 2006

Canada hits bottom on freedom-of-information ranking, new study finds

By: The Canadian Press

January 9, 2011

OTTAWA - A new study ranks Canada dead last when it comes to freedom of information.

Published research by a pair of British academics looking at how well freedom-of-information laws operate in Australia, New Zealand, Ireland, Great Britain and Canada — all of them parliamentary democracies — judged Canada the least open.

New Zealand topped the list, and Canada brought up the rear because its legislation is ineffective and archaic.

The findings published in the journal Government Information Quarterly echo a similar Canadian study from 1998 that showed Canada performs poorly when compared with freedom-of-information laws around the globe.

Critics say the findings are not a surprise, pointing to growing delays in responses to information requests from the public.

And they say it marks a reversal from a decade ago, when Canada was seen as a global leader in freedom of information.

Posted by

Brent Fullard

at

11:14 AM

7

comments

![]()

![]()