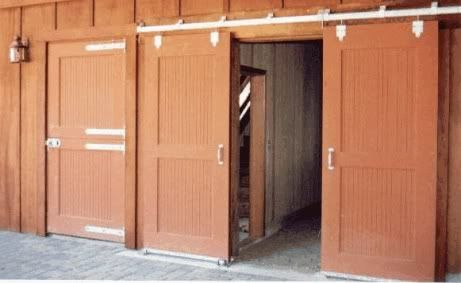

Now that the horse is out of the barn, Manulife CEO Dominic D'Alessandro wants the government to close the door as reported in today’s Globe column entitled: “CEO urges action on takeover frenzy”.

Well the sad truth is that Dominic D’Alessandro was one of those who most visibly argued that opening the barn door was a good thing in the first place. At least for income trusts. At least for him. That was on February 1st when he gave testimony before the highly unbiased and non partisan Finance Committee, as follows:

Mr. Rick Dykstra (St. Catharines, CPC): Mr. Fortin, we've got letters from finance ministers from across this country, from every province in the country. The finance department supports this. Mr. David Dodge has made his comments today, Mr. D'Alessandro, Mr. Dancey. You're in opposition to that and as a former member of the Department of Finance you made an absurd comment that I think discredited you as witness here today by stating that big corporations behind the scenes have influenced the ministry of finance in their decisions. Are you suggesting that's what happened when you actually worked for the Department of Finance? Or is that happening after you left?

Mr. Yves Fortin: No, sir. Mr. Chairman, what I am saying is that the corporations are applauding the measures because it suits them. That's what I'm saying. Do not try to distort what I said.

Mr. Rick Dykstra: That's not what you said in your statement, sir. Mr. D'Alessandro, your position on this in terms of...

Mr. Dominic D'Alessandro: The notion and the implication that somehow the government on this file is responding to initiatives that originated with corporations is not based on reality.

_________

“not based on reality?” Well, let’s explore the revelations on this matter contained in the very testimony of Dominic D'Alessandro, who a few short moments prior to this closing comment of his had these self-contradictory remarks to make:

“It's my opinion that the income trust sector in Canada is increasingly populated by businesses other than those whose principal activity is the operation of real estate or royalty producing assets.”

This is the “not in my backyard” argument.

“We at Manulife Financial engage in a number of businesses in Canada. Some of these businesses could quite conceivably be structured to qualify for income trust treatment. I think this is true for many, if not all of the other financial institutions in Canada. We would all, in time, have faced intense pressures to break up our companies.”

And how pray tell would that have been a bad thing, since doing so may have diminished your empire, but it would have maximized shareholder value (and government tax revenues as well)?

“It is worth remembering that it was for such businesses that the current tax regime was originally designed. In June of last year, CI Financial converted to trust status.”

Okay now we’re getting somewhere close to the root of the problem. Correct, CI Financial was an “early mover” who saw that the tradeoff between the higher value of a trust versus the foregone freedoms of being a corporation, argued in favour of conversion to a trust to maximize shareholder value. In doing so CI achieved a lower and more competitive cost of capital as accorded (solely) by the supply demand dynamic of the market for income trust issuers and not by any “tax loophole” or tax benefit. Given that CI had converted to a trust, this placed pressure on Manulife and Power Financial to do likewise. The CEO’s of these companies had reasons to resist this pressure. Whose purposes did those reasons serve? Shareholders or management?

“I don't think this is the best way to allocate capital within an economy. After all, capital is important for all companies. Capital provides confidence to employees, suppliers, and customers. Capital allows businesses to cope with downturns in activity, and capital provides the means with which to take advantage of growth opportunities which may present themselves in the marketplace.”

This is a facile argument on many levels. First, the capital providers make these capital allocation decisions, not corporations and not management per se. Second, placing restrictions on where capital providers can place their money will hardly lead to optimal economic decisions or optimal capital allocation. Let’s be honest, your goal in killing trusts is to remain the prettiest girl in town. Third, if what you are saying about coping with downturns is true, then are you saying that the Capital Adequacy Guidelines administered by the life insurance regulator are not sufficient? Are you saying that Manulife needs to increase its Tier 1 and Tier 2 capital adequacy? That could easily be arranged on either a voluntary or administered basis if this were a legitimate concern to you. Or was this just calculated fear mongering on your part?

“I don't know why we would want a tax regime that would discourage the accumulation of an appropriate level of retained earnings by the corporate sector.”

Again a very revealing comment. I have a one word answer: BCE. BCE was formed out of Bell Canada. Bell Canada used to distribute all of its earning to a shareholders. Under those circumstances, Bell Canada was a good investment. Bell Canada was subsequently allowed by Parliament to become the holding company known today as BCE for the sole purpose of reinvesting the earnings of Bell Canada. BCE management thought that they were Warren Buffett. They weren’t. They reinvested all the retained earnings in the corporate equivalent of Florida swamp land. That’s why they haven’t paid taxes in decades(?). They are writing off all the squandered retained earnings none of which were in the end “retained” but rather squandered. The overall track record of Corporate Canada on reinevestment returns hardly makes this argument of Mr. D’Alessandro’s a very compelling one. That’s why investors prefer investing in income trusts, they prefer making their own reinvestment decisions, thank you very much.

So there you have it, this whole debate is over who controls investors’ money. Investors themselves or Corporate Canada? Problem is we aren’t an economic island unto ourselves. It would appear that Dominic D’Alessandro has at least wakened up to this reality. There’s still hope that he may acknowledge that Canadians’ investment capital is Canadians’ investment capital and not his. Better come to that realization soon before Canadian investment capital seeks out more favourable investor-friendly markets such as the US High Yield Market, the US Tax Free Municipal Bond Market or the US Master Limited Partnership Market. As was so succinctly stated in the Herold Energy Investment Outlook of February 2007: “Capital flows to where it is well treated.”

I think we will observe a similar phenomenon in the next election, when it comes to where the votes will most easily flow to.

News flash to Flaherty: Prove the case or drop the tax.

Friday, May 4, 2007

Who let the horse out of the barn?

Posted by

Fillibluster

at

4:32 PM

![]()

![]()

Subscribe to:

Post Comments (Atom)

4 comments:

More good stuff .. thanks!

At the FINA hearings, Flaherty testified “Chart A shows clearly this trend in income trust conversions and the path we were all on. As you can see on the chart from '03 to '06 the huge increase in 2006 in the first 10 months only of 2006. This represented a clear and present danger to our tax system and our economic structure. Evidence was mounting that we were running a real risk of turning into an income trust economy, an economy where tax avoidance drove business investment decisions and foreign investors stood to make significant gains at the expense of Canadian taxpayers.”

His interpretation of the evidence that “This represented a clear and present danger to our tax system and our economic structure” is fallacious. And to his conclusion “we were running a real risk of turning into an income trust economy”, we may say ‘So what?’ Recent events show: if you don’t like income trusts, get used to foreign investments done with leveraged buy-outs and expatriation of Canadian income without tax via tax treaty exemptions and inter-company administrative charges.

This Minister of Finance, because he has relied on a small group of ex-spurts who confuse global economics and Canadian finance, has put the Canadian tax system into great danger. Canadians stand to lose control of Canadian investments and jobs in management, finance, professional services and similar. And at the same time, foreign investors will move Canadian income and resources out of Canada and into the Global economy without tax. Yes, it will be good for the G-economy—but disastrous for the Canadian economy and tax system.

So, how do we stop this nonsense? The parliamentary process has failed us. So too has the Canadian financial press failed to bring the full and accurate facts to light, or to bring the Prime Minister to his senses (presumably he has some). Since the Minister has used the Tax Act to do what he cannot do with securities legislation, trust investors may have to seek legal redress by securities, civil and constitutional law. The first securities action against the Government of Canada has been started. But in the end, the legal route only shifts the harm and loss from some aggrieved citizens to all taxpayers. There is one small hope. If Flaherty fails to gain re-election, at least we will not suffer the indignity of having to pay him a Parliamentary pension.

and who,s responsible for this beside the cons, and you can,t raise a peep out of them. THE NDP. the ndp are just as responsible for this thievery. so far they,ve been let off the hook. the general public need to know the true intentions of the ndp and what weasals they really are.

I like that you are following all this, but I am also very frustrated that NOTHING is being done ! This talk means nothing in the macro scope of is the possibilty of the greatest blunder of the Canadian Government !

Post a Comment