...something we've argued for 20 months

The income trust tax was predicated on the assumption that Canada WAS an island unto itself and that Canadians saving for retirement could be dutifully made captive to the investment wares and whims of Manulife Financial and Power Corp.

Wrong. Investment capital is fluid. It can leave the country as easily as it can stay in the country. Harper’s income trust tax served to favour foreign investors like Abu Dhabi Energy and Providence Capital over Canadians saving for retirement......so much so that Harper has tax subsidized the displacement of Canadian taxable investors with foreign non taxable entities and pension funds. The LBO of BCE alone, caused by Harper’s knee jerk income trust tax, will cost Canadians taxpayers the loss of $800 million a year in tax revenues. Brilliant, Bring in the clowns

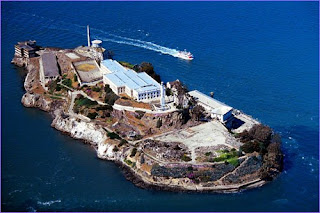

As for Flaherty, he should move to an island.......perhaps Alcatraz.......a perfect place for Canada’s Minister of Tax Leakage Fraud

Flaherty says Canada's energy resources will buffer it from global slowdown

2 hours ago

CALGARY — Finance Minister Jim Flaherty maintains that the country's "strong fundamentals" and status as an emerging energy superpower will keep it in better shape than the United States, although not immune to a global economic slowdown.

"Canada is not an island," Flaherty said to a Calgary Chamber of Commerce luncheon in Calgary Wednesday. He said that Canada is being affected by the "recession" in the U.S. housing sector, which has turned out to be longer and deeper than expected.

It will also have to deal with competition from emerging economies like China and India.

But even still, Flaherty said Canada is the "envy of the G7" with its booming resource industry.

Flaherty said Canada's financial institutions are "well capitalized and strong" and sales of autos in Canada have not declined, as they have in the United States.

Wednesday, July 16, 2008

Flaherty finally concedes that Canada is not an island unto itself

Posted by

Fillibluster

at

6:27 PM

![]()

![]()

Subscribe to:

Post Comments (Atom)

6 comments:

Flaherty said Canada's financial institutions are "well capitalized and strong" and sales of autos in Canada have not declined, as they have in the United States.

Mr Flaherty needs to get out more because he obviously never gets to southern Ontario where the economy is driven by the auto industry.

Car sales in Canada can stay phenomenal but that is only a mere blip on the radar where US auto sales determine the outlook for the industry.

Just today one of our biggest regional employers in St Thomas (Sterling Truck) announced the layoff of just over half of their workforce just in time for Christmas because the sale of vehicles in the US has gone into the dumper.

Our local ford car assembly plant is laying off one of it`s 2 shifts as well.

Mr Flaherty has said that investing in Ontario is folly anyway , so I am sure that he could not care less for these workers & their families.

For a Minister Of Finance he seems to exist in a make-believe world where all is rosy as long as his beloved resource & corporate buddies are happy.

To hell with the little guy--especially in Ontario.

Dr Mike Popovich.

And one more thing, what kind of Finance Minster gives his blessing to a deal that saw BCE go from a publicly owned company to an entity held by a pension fund where no tax will be paid.

Is it not the duty of the Finance Minister to raise money on which to run a country & to not piss it away as he is doing.

He ripped 35 billion dollars from the savings of small investors in order to give his corporate buddies a break--this has resulted in billions of lost gov`t revenue.

He is the antithesis of Robin Hood , stealing from the poor to give to the rich.

What has this country come to.

Dr Mike.

Brent if car sales have not declined in Canada why is GM closing so many plants? Who said that Canada is the envy of the G7 with its booming resource industry? He makes up things as he goes along. Our oil industry has done nothing to advance the job market in Ontario. The man is an imbecile. How is he going to deal with competition from China and India? China, I am sure, is looking at the income trusts and probably will soon start to buy a couple. If we don't own the oil, what have we to offer? Goldman Sachs with the help of Paulson and Carney will soon have a garage sale of Canada's assets. That was Carney's ambition from the time he sat down beside the moron Flaherty and convinced him to cancel income trusts. After all Paulson and he worked together at G-S for 16 years. When conditions improve in the U.S. and their dollar moves up, they will be buying all they can lay their hands on! We need an Iggy as our P.M. to stop the "Barbarians at the Gates.

RR

Since Flaherty likes to talk about tax leakage he should be sent to the Cayman Islands or maybe the Isle of Man and join some of his wealthy fellow Canadians. He would be well received as our tax evaders undoubtedly love his tax free treatment of interest payments. They just got a bit richer thanks to Flaherty.

Y

"Certainly from a government revenue perspective, if we are going into a global economic slowdown they´re going to be looking to preserve their revenue base. Income trusts, as they previously existed, were a real threat to that." Adrienne Oliver, a partner in the law firm Ogilvy Renault and co-chair of the firm´s tax group.

Here is another lawyer that does not get it. After all these lawyers get a B.A. in Geography or Sociology do they give them stupid pills at Osgoode Hall?

Income trusts were a real threat to the revenue base? Holy cow, what an uniformed co-chair of a tax group. Do they believe everything the government says or do they have x-ray vision to read through the blacked-out documents?

Stupid pills are not optional!!!!

Dr mike

Post a Comment