Today we learn that Manulife has lost some 70% of its value since September 15 of this year, an amount equal to $35 billion, which is exactly the amount of money that income trust investors lost from Jim Flaherty’s reckless policy to destroy income trusts. That’s , however where the similarities end. You see, Manulife’s losses occurred because of the global meltdown in stock values. However Manulife was more acutely affected than others for reasons solely of its own creation and mismanagement, whereas income trusts investors lost their $35 billion solely as a result of the Harper government's action and the policy lies that were advanced by Jim Flaherty and Mark Carney that income trusts cause tax leakage.

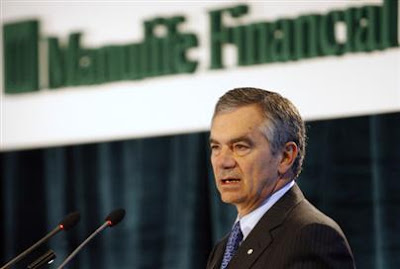

Manulife was one of the groups who benefited most (in the short term) from the government’s actions to kill income trusts. This is why Manulife’s CEO was only too happy to provide testimony in favour of the government’s action to kill income trusts. Much like the child running a lemonade stand on one side of the street would love it if someone (the government?) would close the competing lemonade stand on the opposite side of the street to boost his sales, Manulife and others in the insurance industry went running to the government to kill the competing investment product called income trusts. They coined the resulting exercise as one of “leveling the playing field”, except that actually meant removing the opposing team from the field as the means for "fair play"? For this they relied on the Harper government, who in turn advanced a host of patently false arguments to advance that cause and to defraud 2.5 million Canadians taxpayers of $35 billion of their wealth. While bringing about a host of other adverse consequences.

In fact one of those adverse consequences has come to haunt Manulife itself, who had sought to boost the sales of its variable rate annuity business and other lines of business by killing income trusts. They were successful in doing so, however greed got the better of them as they decided arbitrarily to cease hedging the risks that this new book of business represented to their balance sheet. This was done for the sole reason of boosting (some would say artificially) Manulife’s earnings per share, which in turn would maximize the value of management’s stock options. Unfortunately for Manulife’s management, things didn’t work out quite as planned. Turns out they aren’t the masters of the universe they think they are. They were smart enough to dupe the Harper government into killing income trusts, but they weren’t smart enough to realize the house of cards they had built for themselves and the undue risks they were taking in their gamble on annuities providing guaranteed investment returns.

Manulife’s solution in recovering $35 billion of lost value is a lot tougher, as it should be, than it is for income trust investors. We simply need to lift the veil on the lies of the Stephen Harper government as it pertains to his fraudulent claims of tax leakage and ensure that the Liberal party remain true to their word to rescind this absurd and self destructive income trust tax.

Good luck Dominic. Even your in-house newspaper, the Globe and Mail, is saying that its time for you to confront reality.. The one of your own creation, as distinct from the fabrications foisted on income trust investors by the Harper government.

Tuesday, February 24, 2009

Manulife loses $35 billion in value, equal to the loss it helped inflict on trust investors

Posted by

Fillibluster

at

8:14 AM

![]()

![]()

Subscribe to:

Post Comments (Atom)

5 comments:

There are not many CEO's Flaherty sees eye to eye with. Dominic may be the only one.

Harold

I GUESS MANULIFE SHOULD HAVE DIVERSIFIED OR SPENT MORE TIME WORRYING ABOUT THEIR INVESTMENTS AND LESS ABOUT OURS.

Factrbest

It`s truly sad to see a Canadian icon of a business go down in flames because of internal mismanagement.

Even with a gov`t leg-up it could be tits-up.

I know I should feel bad but ......

Dr Mike Popovich.

THE SUPREME IRONY OF ALL THIS, IS THIS IS THE PRODUCT THAT CAUSED

DOMINIC D. TO WORK LIKE HELL TO KILL THE TRUSTS.

SOMETIMES IN BATTLE BOTH WARRIORS DIE

SS

If a CEO managed a company that lost 70% of its value, what kind of performance do you think?

This is simply mismanagement. You can not say this is a global economic problem, the management should have protected the company from exposure to risky investment.

Harper told us that we have a healthy bank structure, and we don't have the same mortgage system as in America. It looks like our government will need to save the insurance industry very soon.

If the insurance sector go down, it will hurt the senior more. Seniors already suffered from no interests from saving, cut back from dividend income, and now their life insurance is at risk. It is time for Harper to confront the reality...save the income trust. Sooner or later most of the seniors can not live financial independently, they will line up for welfare.

Trustmanic

Post a Comment