“Harper said his government "can't ignore" the allegations because they relate to Mulroney's term in office and they must "always protect the office of the prime minister."

Friday, February 29, 2008

Cadman affair gives new meaning to the words:

Posted by

Fillibluster

at

6:37 PM

18

comments

![]()

![]()

Sorry Steve, Cadman's absolution is absolving Paul Martin, not you

Steve Harper is asking Canadians to rely on Chuck Cadman’s comment that he received no quid pro quo for his vote.

Think about it for a moment.

Cadman voted with the Liberals. Who do you think the reporter was referring to when he asked Cadman whether he received a quid pro quo. The Conservatives or the Liberals?

To the extent there is any doubt in your mind, then there’s Steve’s own admission and self incrimination: “The offer to Chuck was blah blah blah.....”

-

Posted by

Fillibluster

at

6:22 PM

5

comments

![]()

![]()

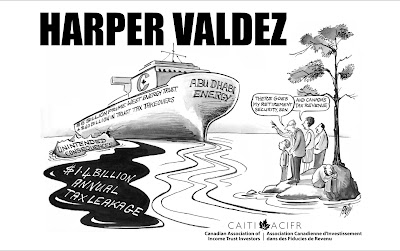

Liberal Finance Committee Members call on Auditor General to Examine Government's Claims of Income Trust Tax Leakage

For Immediate Release

February 29, 2008

Liberal Finance Committee Members call on Auditor General to Examine Government's Claims of Income Trust Tax Leakage

OTTAWA - Liberal Members of the Standing Committee on Finance today called on the Auditor General to investigate the tax leakage claims that the government used as the basis for its October 31, 2006, decision to tax income trusts.

"I think that this government's stonewalling has gone on long enough and it's time that Canadians got to see that the Government simply made up its story that income trusts cause federal tax leakage," said Liberal Finance Critic John McCallum.

"Prime Minister Stephen Harper promised to Canadians that he would never tax income trusts. Then he went back on his word, costing Canadians billions overnight and in the wake of his silence on the issue we feel that only the Auditor General can shine some light into this matter."

All four Liberal Members of the Finance Committee signed a letter to Auditor General Sheila Fraser asking her to investigate the matter, particularly the government's unproven allegations about income trusts causing tax leakage.

"This has clearly become much more than just another instance of the government not doing its homework before acting. It has become a full-blown scandal and cover-up," said John McKay, Member of Parliament for Scarborough-Guildwood. "We have tried virtually every tool at our disposal to get the government to show us how they came to their conclusions about tax leakage and the Auditor General may be Canadians' last resort."

An Access to Information request asking for the Department of Finance's assumptions, data and methodology resulted in the release of only 23 pages of documents that are almost entirely blacked out.

A direct request from the Finance Committee to see the data was met with two thick binders of superfluous information that did not contain the data or methodology originally requested.

A written question was placed on the Order Paper asking the government to recalculate its estimate of tax leakage using the 15 per cent federal corporate tax rate that will actually be in effect in 2012, the year after the income trust tax begins, as opposed to the 21 per cent tax rate that was in effect at the time of the announcement. The government's response to the question indicated that that this would be a hypothetical calculation and therefore impossible to do.

"That's not a hypothetical, that's what the federal tax rate will be," said Garth Turner, Member of Parliament for Halton. "If the government can't manage to run the new 2012 corporate tax rate through their calculators then I have no reason to believe they ran the old one through their calculators in October of 2006."

In 2006, Stephen Harper ran on a campaign commitment to never tax income trusts. The Conservative election platform characterized any attempt to impose such a tax as, "An attack on retirement savings."

"That election commitment was obviously a falsehood. Unfortunately the voters who believed it and invested even more money in income trusts lost a significant portion of their nest eggs," said Massimo Pacetti, Member of Parliament for MP for Saint-Léonard-Saint-Michel.

"Even today, 15 months after they broke their election promise, Members of Parliament still hear from the thousands of Canadians whose retirement plans were shattered by this deception. Liberal Members of Parliament continue to stand up for them."

-30-

The full text of the letter sent to the Auditor General is attached.

To see the government response to written question 149 on the Order Paper please visit: www.liberal.ca/pdf/docs/080229_Q-149_en.pdf

Contact:

Office of Hon. John McCallum

(613) 996-3375

Posted by

Fillibluster

at

1:58 PM

2

comments

![]()

![]()

Why an insurance policy? Why not cash?

It's obvious. Because it's devious. We are talking about Stephen Harper after all.

A cash payment would be taxable to Cadman. Life insurance policy payouts to his family are not.

A cash payment would “own” Cadman for a fleeting moment in time. An insurance policy would “own” him for the balance of his life.

A cash payment is cold. An insurance policy tears at the heart strings.

Remember. Stephen Harper is be trusted implicitly. Just ask 2.5 million income trust investors.

-

Posted by

Fillibluster

at

12:15 PM

4

comments

![]()

![]()

My correspondence from Stephen Harper

Now you know why I never got past the second paragraph of this slimy letter from Stephen Harper dated November 24, 2006, at the point in the letter where the Harpster proclaimed “Canadians must trust.”

What unmitigated nonsense and utter crap: Canadians must trust.

Goodbye Stephen Harper. You are toast-man. Never again will your dark shadow of corruption cast its sinister rays over the future of this country.

Get stuffed and put a sock in it, is my response to both you and your letter. Stop trying to exploit Canadians' predisposition to trusting, as you cynically attempt to pull off your inherently corrupt agenda.

November 24, 2006

Dear Mr. Fullard:

Thank you for your e-mail message regarding the government's decision on income trusts. I am pleased to have this opportunity to respond.

I understand your disappointment with this decision. We recognize that Canadian investors, including many pensioners and seniors, have made important investments over the years and benefit from the current income trust structure. However, Canadians must trust that their government is watching out for them and is upholding the values that define us, like fairness. They expect us to fix problems, right injustices and close loopholes.

As you know, over the past few months we have seen a clear tax avoidance. trend in the creation of new income trusts. Corporations are converting to these structures and the decisions are based largely on tax considerations. The sheer number and size of the Canadian companies attempting to gain short-term tax benefits was threatening Canada's long-term economic growth. Corporations have used this tax rule to create an economic distortion. This year alone there have been almost $70 billion in new income trust announcements.

Canada's New Government strongly believes that the tax system must be progressive, fair and competitive. It must provide the right incentives to create an economic advantage for companies to invest and grow. The tax system must create an advantage for Canada, not an unfair advantage for some Canadian corporate taxpayers. The current income trust situation is not fair.

When corporations don't pay their share of taxes, this burden is shifted on to the shoulders of hardworking individuals and families. We have taken decisive action to protect the best interests of all Canadians. Our Tax Fairness Plan will restore balance to the federal tax system and level the playing field between income trusts and corporations.

Our plan is the result of months of careful consultation and evaluation. The measures we have chosen represent a major tax reduction. The Tax Fairness Plan will deliver over $1 billion of tax relief annually to Canadians. The plan includes:

1) A distribution tax on distributions from publicly traded income trusts.

2) A reduction of the general corporate income tax rate of one half percentage point effective January 1, 2011.

3) An increase in the Age Credit Amount by $1000 from $4,066 to $5,066 effective January 1, 2006. This measure will provide tax relief for low and middle income seniors.

4) The government will permit income splitting for pensioners beginning in 2007. This will significantly enhance the incentives to save and invest for family retirement security.

The Tax Fairness Plan restores balance and fairness to Canada's tax system. It will ensure that our economy grows and prospers, while bringing Canada in line with other jurisdictions. It is the responsibility of the Government of Canada, not corporate tax planners, to set our nation's tax policy. Taxes must not be shifted unfairly onto the shoulders of individuals and families. We have developed a plan that upholds the value of fairness and delivers major positive changes in tax policy.

Once again, thank you for taking the time to share your thoughts. I invite you to visit the Department of Finance website at http://www.fin.gc.ca/news06/06-061e.html for full details regarding the Tax Fairness Plan.

Sincerely,

The Rt. Hon. Stephen Harper, P.C., M.P.

Prime Minister of Canada

Posted by

Fillibluster

at

8:26 AM

3

comments

![]()

![]()

Dominic D'Alessandro and the serendipity of Harper’s income trust tax

ser·en·dip·i·ty /ˌsɛrənˈdɪpɪti/

–noun

1. an aptitude for making desirable discoveries by accident.

2. good fortune; luck: the serendipity of getting the first job she applied for.

We believe you Dominic. The income income trust tax fraud fell from the sky. You played no part whatsoever. How remotely credible was it for your to have testified before Parliament that:

Mr. Dominic D'Alessandro: “The notion and the implication that somehow the government on this file is responding to initiatives that originated with corporations is not based on reality.”

Meanwhile the Globe and Mail had this to say about Paul Desmarais Jr’s unregistered lobbying activities on this file. Believe it or not Dominic, we aren’t quite as dumb and gullible as you take us for, we aren't Judy Wasylycia-Lies, we can actually read:

“High-profile directors and CEOs, meanwhile, had approached Mr. Flaherty personally to express their concerns: Many felt they were being pressed into trusts because of their duty to maximize shareholder value, despite their misgivings about the structure. Paul Desmarais Jr., the well-connected chairman of Power Corp. of Canada, even railed against trusts in a conversation with Prime Minister Stephen Harper during a trip to Mexico, and told him he should act quickly to stop the raft of conversions, according to sources.”

Posted by

Fillibluster

at

8:00 AM

2

comments

![]()

![]()

Cadscam trumps adscam.

The corruption in the Harper government is legend. Starting with the fraud known as tax leakage and the Tax Fairness Plan which is better know as the alms for narrow interests plan.

Funny how an insurance policy plays the central role in the recent Cadscam incident. Which blows the doors off Adscam

The fact that Tom "Rasputin" Flanagan is alleged to have played a central role in this along with Doug Finlay is too delicious for words. He of the Leo Strauss school and its philosophy of the permissible "big lie". The fact that Flanagan denies being a follower of Strauss, proves that he is. Along with his own self professed conduct as Harper campaign manager in the 2006 election of lies, along with help from the RCMP and Judy Wasylycia-Lies of the Newly Duped Party.

Sorry, you're toast my friend. Now, more than ever.

-

Posted by

Fillibluster

at

7:14 AM

5

comments

![]()

![]()

The crazy glue that binds the uneconomic to the unethical: Teachers’ $587 million reverse break fee

By: Brent Fullard, Catalyst Asset Management Inc.

Since when did pension plans start playing Russian Roulette with their plan assets?

Here we have Ontario Teachers’ placing itself in a position where they and their partners have to pay $1 billion "reverse break fee" if they are unable to raise $32 billion in junk bond financing for the largest leveraged buyout in history.......in one of the worst debt markets in history.

What may have been a remote possibility back in June 2007, has become a very real possibility in March 2008. Even though there is still only one chamber that contains a bullett, the 1000 chamber gun of June 2007 has been replaced with a four chamber gun of 2008.

Which makes one wonder, where in the mandate governing Teachers’ is the provision that allows it to play Russian Roulette by taking on large lumpy risks that it has no ability to syndicate, hedge or even manage? Afterall, Teachers’ disproportionate share of this risk is $587 million. I wonder how much of that money is coming from Morgan McCague, the straw horse individual who were are asked to believe holds two thirds of the votes of BCE’s new owner, Holdco.

Maybe the downside to Morgan McCague is that he forgoes the $10,000 a year he gets to participate in this artifice of ownership that allows Teachers’ to do indirectly what Teachers’ is precluded from law doing directly, namely own more than 30% of BCE. Too bad the law also prohibits Teachers’ from doing so indirectly as well.

Perhaps it was premature of me to say that Teachers’ is unable to manage the $587 million risk they have exposed themselves to. By that I mean, Teachers; has no ability whatsoever to affect the state of the global leveraged loan marketplace. However Teachers is probably using moral suasion to the max with its lending syndicate to proceed with a deal that is inherently uneconomic.

On Monday of this week, I made that observation to the Chairman and Commissioners of the CRTC, when I stated:

“Yes. And the risk about this debt financing is not some abstract arcane ‑‑ just read the headlines. I mean any number of leverage buyouts are not getting financed. And so to the extent to which the providers, the brokers; the syndicate of banks is willing to pony up for their risk, they are not the long term holders. Their ultimate goal is to find people who are. And presently this deal from the standpoint of many third parties is an uneconomic transaction that's unlikely to attract long term debt investors.”

That was perhaps more of a bold statement on Monday of this week than it is on Friday of this week, since yesterday TD Bank as one of the members of the Bank syndicate finally admitted the truth and dropped their bold bravado by admitting that they have already taken right downs on this loan amounting to between $165 - $330 million, despite comments by their CEO as recently as two weeks ago that they would do this deal again. Yeah, right. Banking can be this “easy”.

So no doubt Teachers' is running around trying to use all the moral suasion it has to force its syndicate of banks to do what is inherently uneconomic, Lend $1.00 against something that is worth $0.90 or less. Meanwhile, elsewhere in the world, banks are pulllng their loans from similar deals, which is the correct economic thing to do.

Meanwhile, Teachers wants them to press on doing what is inherently uneconomic. By blindly pressing on, Teachers is also calling upon these banks to do a deal that is also inherently unethical. Unethical on at least two fronts, the aforementioned artifice of ownership involving Morgan McCague, whose sole intent is to skirt the regulations of the Pension Benefits Standards Act, as well as fundamental Disclosure 101 rules, which a recent ruling by the OSC, provides that a Bid Circular must contain:

“Information should be disclosed if there is a substantial likelihood that a reasonable shareholder would consider it important.”

BCE failed to disclose the Catalyst Proposal even though it was a fundamentally different choice from the $42.75 cash offer, since it provided the following unique benefits:

Increases dividend by 74%

Market value of between $42.50 and $52.00

70% tax free rollover

Preserves all the upside in BCE

Avoids reinvestment risk

No deal risk, since deal is self financing, requires no CRTC approval and preserves bondholders rights

It's no wonder then, that comments like the following have appeared in the comment sections of recent Globe and Mail articles:

“I sure hope Catalyst’s Plan is still available for shareholder approval. That Plan should have been presented for Shareholder consideration at a minimum - the fact that IT wasn't should be enough to scuttle this outrageous deal.”

“ This whole screw up was the making of Sabia and Flaherty, hidden behind the Income Trust Tax Leakage smokescreen. It's borderline criminal that the catalyst proposal was not presented as an option for shareholders to vote on.”

So here we have Ontario Teachers’ playing Russian roulette with the plan assets they manage which will very likely see them have to pay a $587 million reverse break fee. Alternatively they can proceed with a deal that is inherently uneconomic and thereby ask a syndicate of banks to take their own respective right downs in order that, what?

In order to take Canada’s most widely held public company private and transform Canada’s largest telecom into a debt ridden, crack cocaine equivalent junk bond issuer. The result of which will be to increase phone costs, lessen competitiveness, lay off workers in a knowledge sector and reduce Ottawa’s annual tax collection by $729 million a year?

Where is the sense in all of this? There is none.

Ottawa should pull the plug. Disconnect Teachers’ phone service. They have two ways to do it. The CRTC, acting independently, or Industry Canada. Let’s see if Canada’s New Government can at least get one thing right. Meanwhile, if Teachers had any sense, they would be down on bended knee asking for the same thing instead of sniffing their own crazy glue in a desperate attempt to look like they're "smart money".

Meanwhile Teachers' ignored Catalyst's letter of February 4, 2008, outlining a prudent way out of this train wreck in the making (available at canadiansolution.ca).

Posted by

Fillibluster

at

6:39 AM

2

comments

![]()

![]()

Thursday, February 28, 2008

Whose version of events would you believe? The dead man or the politically dead man walking?

I vote for the latter:

Scratchy tape begins with Harper request: 'This is not for publication'

Thu, 2008-02-28 21:15.

By: Alexander Panetta, THE CANADIAN PRESS

OTTAWA - The voice on the scratchy tape is unmistakably Stephen Harper's.

It was as unmistakable as his concern that the tape's contents might one day be made public. Harper interrupted a local reporter in 2005 when asked about allegations his party had offered financial enticements to a dying MP to win his support on a critical vote.

"This is not for publication?" Harper asked Tom Zytaruk.

He was told that the interview was intended as fodder for a biography of Chuck Cadman, the late MP from Surrey, B.C.

But the ensuing two minutes, 21 seconds of audio raise questions about apparent discrepancies between what the prime minister said Thursday and what Harper himself said on the tinny tape more than two years ago.

The prime minister said Thursday he looked into claims Cadman was offered financial considerations and determined they were untrue.

The tape suggests Harper was not only aware of a financial offer to Cadman, but that he gave it the go-ahead, while urging party emissaries not to "press" Cadman too hard.

Harper's conversation with B.C. journalist Tom Zytaruk took place outside the Cadman residence just after Harper paid a courtesy visit to the former MP's widow shortly after his death.

"The offer to Chuck was that it was only to replace financial considerations he might lose due to an election," Harper says.

And Harper says of the people who made the offer: "They were legitimately representing the party."

Here's how Harper summarizes his instructions to those party operatives: "I said, 'Don't press (Cadman), I mean, you have this theory that it's, you know, financial insecurity, and you know, just, you know, if that's what you're saying make that case,'but I said, 'Don't press it."'

The Liberals have already sent a letter to the RCMP asking for an investigation into whether the entire incident could violate the bribery provisions in Section 119 of the Criminal Code. The Mounties said Thursday they're examining the request.

Harper is clear on the tape that he never expected the overtures to succeed. Cadman did in fact vote to rescue the Martin government.

"I don't know the details. I can tell you that I had told the individuals, I mean, they wanted to do it. But I told them they were wasting their time. I said Chuck had made up his mind."

-

Transcript of author's tape of Harper sheds light on Cadman case

OTTAWA - Transcript of a portion of author Tom Zytaruk's tape of a 2005 interview with Stephen Harper, then leader of the Opposition, for his biography of the late Chuck Cadman:

Zytaruk: "I mean, there was an insurance policy for a million dollars. Do you know anything about that?"

Harper: "I don't know the details. I know that there were discussions, uh, this is not for publication?"

Zytaruk: "This (inaudible) for the book. Not for the newspaper. This is for the book."

Harper: "Um, I don't know the details. I can tell you that I had told the individuals, I mean, they wanted to do it. But I told them they were wasting their time. I said Chuck had made up his mind, he was going to vote with the Liberals and I knew why and I respected the decision. But they were just, they were convinced there was, there were financial issues. There may or may not have been, but I said that's not, you know, I mean, I, that's not going to change."

Zytaruk: "You said (inaudible) beforehand and stuff? It wasn't even a party guy, or maybe some friends, if it was people actually in the party?"

Harper: "No, no, they were legitimately representing the party. I said don't press him. I mean, you have this theory that it's, you know, financial insecurity and, you know, just, you know, if that's what you're saying, make that case but don't press it. I don't think, my view was, my view had been for two or three weeks preceding it, was that Chuck was not going to force an election. I just, we had all kinds of our guys were calling him, and trying to persuade him, I mean, but I just had concluded that's where he stood and respected that."

Zytaruk: "Thank you for that. And when (inaudible)."

Harper: "But the, uh, the offer to Chuck was that it was only to replace financial considerations he might lose due to an election."

Zytaruk: "Oh, OK."

Harper: "OK? That's my understanding of what they were talking about."

Zytaruk: "But, the thing is, though, you made it clear you weren't big on the idea in the first place?"

Harper: "Well, I just thought Chuck had made up his mind, in my own view ..."

Zytaruk: "Oh, okay. So, it's not like, he's like, (inaudible)."

Harper: "I talked to Chuck myself. I talked to (inaudible). You know, I talked to him, oh, two or three weeks before that, and then several weeks before that. I mean, you know, I kind of had a sense of where he was going."

Zytaruk: "Well, thank you very much."

Posted by

Fillibluster

at

10:50 PM

12

comments

![]()

![]()

Speaking of Chuck Cadman, just who exactly did fund Harper’s 2002 leadership campaign?

I use the term “leadership” lightly here, but just who exactly did fund Stephen Harper’s 2002 leadership campaign?

Archer Daniels Midland?

Posted by

Fillibluster

at

6:34 PM

3

comments

![]()

![]()

Harper's failed PhD thesis was on the elasticity of truth

Posted by

Fillibluster

at

5:26 PM

3

comments

![]()

![]()

Was it a life insurance policy bribe?

So today we learn that the Conservative Party tried to bribe Independent MP Chuck Cadman back in 2005 to vote along with the Conservatives in order to topple the Martin Liberal government.

And what form did the bribe allegedly take? A $1 million life insurance policy.

Now where would the Conservatives get a life insurance policy from, for a guy who was hardly in the best state of health?

Well my guess is that this life insurance policy came from any number of sources, since a life insurance policy is merely a contract with a conditional payout that anyone can write for any risk they are willing to take on, including someone with a terminal illness.

As such, Stephen Harper is not a leader, unless you consider a leader to be someone who is deceitful, as Harper proved himself to be on his income trust betarayal and his false and unproven reasons for reversing his solemn election promise.

Unlike Flaherty with his speechwriter friend's untendered government contract, do you suppose the Conservative’s shopped around for the best life insurance policy they could find for Chuck Cadman. If so, no doubt they turned to Brian Pallister, broker extraordinaire.

-

Posted by

Fillibluster

at

12:31 PM

11

comments

![]()

![]()

Wednesday, February 27, 2008

Announcing: Jim Had His Chance.ca

Now that we have that budget thingy out of the way and Jim's latest exercise in Trusting Flaherty Spells Anguish (TFSA), we can get down to the real business of Finance Minister Jim Flaherty, which is to assure the citizens of Whitby-Oshawa that they know all that there is to know about their Member of Parliament.

To facilitate that process, we have begun rolling out a series of billboards in Jim's own back yard dealing with a diverse range of topics that ordinarily fall under a Finance Minister's broad mandate.

Issues ranging from "I don't fix potholes" to "it's not my fault" are the topics of but two of these boards.

Then of course there is the website itself entitled Jim Had His Chance.ca

Depending in how well this works out, we have also reserved the URL entitled

SteveHadHisChance.ca

If you have any catchy suggestions or particularly irritating topics for upcoming billboards in Jim's riding, please post your comments below or e-mail us at suggestions@JimHadHisChance.ca

Remember, you only get one chance. Make it a memorable one. Just like Jim himself.

-

Posted by

Fillibluster

at

4:44 PM

33

comments

![]()

![]()

With Jim Flaherty, yesterday's sin, becomes today's virtue

Do you suppose the Liberal brain trust and Power brokers like unelected Senator David Smith will be able to connect these two hypocritical dots staring them straight in the eyes?

(1) It’s quite remarkable that at a time when the country was gushing with surpluses, that the Harper government felt compelled to shut down income trusts in order to stem alleged tax leakage on the basis that:

“Well, as Minister of Finance, I have a fiduciary obligation to the taxpayers of Canada today, not tomorrow, an obligation to pay for needed social, environmental and economic programs today, not tomorrow. I cannot, and I will not, fund today's programs from tomorrow's revenues.”

(2) Such corrupt logic is an absolute crock in terms of financial theory, made ever more so by the fact that we are now at risk of budget deficits and Flaherty’s announcement of a TFSA thingy, as reported in today’s Globe and Mail entails an arrangement whereby:

“Staring in 2009, people 18 and older will be able to put up to $5,000 a year in a Tax Free Savings Account and rack up investment gains without paying taxes, even at withdrawal”

I am at my most facetious when I say that no doubt this will lead to articles of condemnation in the Toronto Star by David Olive entitled Income Trusts 3.0 or a fine erudite piece by Eric Reguly in which he declares the TSFA to be the second coming of Capitalism for slobs

No doubt Power Corporation will be able to make the TFSA work for them in a way that they couldn't compete with income trusts and embarked on enjoining the Harper government to kill them on false grounds.

All I know is that Trusting Flaherty Spells Anguish.

Posted by

Fillibluster

at

10:22 AM

6

comments

![]()

![]()

Memo to Ralph Goodale

The following memo was delivered in person to Ralph Goodale by the author at a gathering in Garth Turner’s home. There’s no evidence that any of this wise advise has been taken to heart by the Liberals.

Bottom Line: If you’re not part of the solution. You’re part of the problem.

To: Ralph Goodale

Date: Thu, 11 Oct 2007 07:41:53 -0400

Subject: The Liberal's Messaging on Income Trusts

As a person who has spent an inordinate amount of time on this issue (pro bono) and someone who has been proven correct in his predictions (I wasn’t the only one) about the impact of this policy and its many far reaching effects, please allow me to provide you with some unsolicited advice:

In my opinion, your “messaging” on income trusts is in need of work, as evidenced by Dion’s speech in Edmonton yesterday (income trust excerpts below) . In my opinion this messaging is dated and stale and does not resonate with “the larger audience”. Believe me when I say “Who really cares about restoring two thirds of investors’ lost savings apart from the investors themselves?”.

That messaging of restoring two thirds of the lost value yours was great for February 13, 2007, the day you announced your policy position of a 10% tax. It is clearly not great today, as it ignores all the corroborating events that have occurred since that time, all of which are god sends to our cause and in making our/your case . This current messaging will gain you as many voters as it lose voters, witness the editorials following the Calgary consultation a few weeks ago.

You gave the press nothing new or substantive to ruminate over, apart from the fact that you were consulting with affected parties which was then cynically portrayed by the press in strictly political terms. You didn’t attack the core falsehoods of this policy or make the direct causal link to takeovers.

You didn’t mention the blacked out documents released under ATI. The government’s tax leakage analysis is clearly wrong in that it leaves out 38% of the taxes paid on income trusts. It’s a proven and verifiable fact. You know that, I know that. This is a scandal that is being masked. Who benefits from that?

You have to elevate this issue to the level where all Canadians realize this is negative to them and their children's and grand children's’ futures. That’s easy: loss of sovereignty, loss of general tax revenue. The evidence is firmly in place. Use it. Connect the dots.

We’re not making this stuff up or falsely portraying how our issue so readily morphs into vastly larger issues and themes like accountability, transparency, sovereignty, lost tax revenues, hollowing out, betrayal at the hands of government, hidden agenda, gross inequities (pension plan carve out), gross ineptitude (BCE, Prime West) etc.

Make the policy connection. People need to have their “entrenched” views, which have only been established by resonating “intuitive” rhetoric, challenged through the process of “cognitive dissonance” using known facts and subsequent events. Cognitive dissonance is the only way people will rethink their current view on something.

People need to be challenged with an “outlier observation” which is inconsistent with their world view and you then offer them an alternative explanation for the entire ball of wax. There are a vast number of “outlier” observations in our quiver. For example, 7 of the 25 largest takeovers of the last 5 years have occurred in the mere 11 months that this policy has been in existence and as a direct consequence of this policy. Many other foreign takeovers will follow. The arguments against this policy are endless.

Which Canadian is unaware about what the reasons for Harper’s shut down of income trusts were?(BCE and Telus), and what ultimately happened in the short space of 8 months (private equity takeout of BCE and the LOSS of $793 million a year in taxes)? How many Canadians think selling our energy to the middle east is a good idea? Prime West is a trust......hmm?

Cognitive dissonances takes the form of 18 pages of blacked out documents, BCE going private in face of denial to become a trust. Abu Dhabi purchase of Prime West, Prentice’s non announcement about foreign takeovers maybe yes maybe no solely designed to chill the takeovers without addressing the issue itself and designed simply to avoid further embarrassments from Abu Dhabi’s #2 through 250.

The Liberal party simply needs to appeal to the enormous base of support that is latent in the minds of Canadians. Latent yet visceral concerns about issues like foreign takeovers (72% of Canadians concerned according to recent poll). Canadians innate oncerns about accountability and transparency of government as viscerally conjured up by 18 pages of blacked out documents (92% of Canadian think its wrong – Angus Reid poll).

Play to Harper’s weaknesses and attack his presumed strengths. Is there a hidden agenda with this man? (blacked out documents)! Is he a strong leader? ( Abu Dhabi yes/no!) Does he make good policy decisions? (BCE?) Can he be trusted ( income trust mother of all lies). These questions don’t even have to be explicitly asked. When faced with the evidence in the proper way and framed in the correct context, people will ask these questions of themselves. What is more powerful than that?

This issue is a gold mine that is not being mined properly, less so to make a point about the income issue per se, but for you to make the larger issues that resonate with every voter and not just a handful of voters. Our country. Our democracy.

Let me know if you disagree. I would like to help in any way I can. We have a huge vested interest in seeing the Liberals form the next government. So too the entire population, they just need to know why.

A lot of good food is going to waste.

Brent Fullard

President and CEO

Canadian Association of Income Trust Investors

www.caiti.info

647 505-2224 (cell)

Posted by

Fillibluster

at

6:07 AM

5

comments

![]()

![]()

Tuesday, February 26, 2008

BCE: Sure looks Canadian controlled to me?

This intricate spider web of multilevel ownership through various classes of shares was tabled by BCE and Teachers at the recent CRTC Public Hearings in a document entitled: "Reference Materials Regarding Control-in-Fact Issues for the CRTC"

Looks more like a sub prime mortgage conduit diagram to me, which it most certainly is as well. Almost as certain as the intent of the following:

Section 11 of Schedule III of Teachers’ governing regulations provides that:

“the administration of a plan shall not, directly or indirectly, invest the moneys of the plan in the securities of a corporation to which are attached more than 30% of the votes that may be cast to elect the directors of the corporation”.

Meanwhile the CRTC doesn't appear so easily wowed with the actual "control-in-fact" circumstances of this proposed arrangement:

CRTC raises concerns about BCE takeover

The Toronto Star

Ross Marowits

Canadian Press

Posted by

Fillibluster

at

7:01 PM

0

comments

![]()

![]()

Monday, February 25, 2008

Hey Flaherty, how about a budget that includes the other 85% of seniors you left out of your earlier income splitting scheme?

In keeping with the lie, conceal, fabricate nature of Finance Minister, his much ballyhooed income splitting for seniors announced at the time Flaherty also reversed his promise to never tax income trusts and never raid seniors nest eggs, he embarked on an equally fraudulent scheme known as income splitting for seniors. The fact that it leaves out 85% of seniors is totally lost on the journalistic community and therefore the public at large.

In this regard the press is acting as accomplices to an inherently dishonest Finance Minister, and love to praise hin for his (misguided) decisiveness.

Here was an e-mail that was written by Yves Fortin, a retired senior member of the Department if Finance, from the days when the department had integrity. If anything Yves assumption about 30% of Canadians having defined benefit pension plans is an exaggeration. Recent studies indicate the number is 25%.

Subject: Re: Income Splitting for Seniors: Who actually benefits?

Sent: Monday, March 19, 2007 9:22 AM

Brent,

How many will actually benefit from Flaherty's discriminatory pension income splitting scheme?

1. Of the 30% of seniors who receive a pension I would say may as many as one quarter are widows/widowers, single, divorced, separated. That brings down the number of eligible seniors to 22.5%.

2. Of the 22.5% who are eligible as many as 25% may have spouses who have significant income of their own and who may be in a tax bracket not too different from the spouse receiving the eligible pension income. In their case there will be little or no tax reduction resulting from pension income splitting. We are down to 16.7% of seniors receiving a pension.

3. Many ot the remaining seniors receiving a pension but who had low paying jobs are in the lowest tax brackets and pension income splitting with a spouse/partner receiving OAS will not mean very much if anything.

4. All factors taken into consideration pension income splitting may not be of any useful benefit to more than maybe 12-14% of seniors.

5. Of those the ones who will benefit the most are seniors with fat pensions and stay at home spouses/partners. A retired federal judge or a retired deputy minister with a pension of over $100,000. with a stay at home spouse with no significant income will benefit handsomely. They will even be able to reduce or eliminate the clawback of OAS.

Question: What will be the real cost of this discriminatory scheme be for the government. ANSWER: Most likely a fraction of the big numbers Flaherty will announce in his budget.

Yves Fortin

Posted by

Fillibluster

at

7:37 AM

2

comments

![]()

![]()

Sunday, February 24, 2008

A nation of sellouts? I think David Olive needs to speak with his boss and take a look in the mirror

David Olive of the Toronto Star asks the self evident question of the day in today’s paper: “A nation of sellouts?”

David needs to read:

Where is Parliament on the rape and pillage of Canada's largest telecommunications company: BCE?

Since, meanwhile his boss, Rob Prichard , CEO of Torstar is writing to the CRTC (read here) in support of the leveraged buyout of BCE, arguing the sellout in these terms:

“I write to extend the support of Torstar Corporation to BCE Inc.’s application for a change in ownership and control......We are also investment partners with Ontario Teachers’ in CTVGlobemedia. I am a member of that Board of Directors, on which Jim Leech, CEO of Teachers’ is also a member. I have seen him demonstrate as a major investor Teachers’ appreciation for the needs of consumers.”

I guess that means the 240 basis point increase in the cost of BCE’s capital won’t lead to increased monthly phone bills the way the Industry Committee would have us believe:

“A higher cost of capital slows the rate of capital investment and, in turn, the roll out of competitive services

A cost of capital differential of approximately 1.18% exists between Canada’s incumbent telephone carriers and Canadian cable companies. This incremental cost equates to about $1.46 per month per cable subscriber.”

Meanwhile the same journalist, David Olive of Toronto Star wrote an opinion piece in September 2007 entitled: Income Trusts 2.0, an unwanted sequel:

Doesn’t David Olive understand finance? The LBO of BCE is that very Income Trusts 2.0, an unwanted sequel, except in this case the tax leakage is for real and not just a fraudulent argument being advanced by Mark Carney

Perhaps David should bone up on this article from the Financial Post, before he next puts pen to paper:

Flaherty's tax conundrum: BCE Privatization could cost him $800-million

I think the nation of sell outs are the journalists at the Star, to wit:

Will the Toronto Star ever find its inner Woodward/Bernstein?

Meanwhile, read about the Star’s complete exercise in non-culpable hypocrisy:

A nation of sellouts?

What hope is there for Canada to be anything but a second-tier, resource-dependent player on the global stage if every time a corporation approaches critical mass, it gets sold off to a foreign buyer?

Feb 24, 2008 04:30 Am

DAVID OLIVE

BUSINESS COLUMNIST

Posted by

Fillibluster

at

2:17 PM

1 comments

![]()

![]()

The NDP is a blind faith organization

NDP MP Denise Savoie in a letter to a concerned constituent:

“I have asked Judy Wasylycia-Leis to investigate a number of concerns. I am confident in supporting her position on this matter: “I am confident that government estimates of future tax leakage are solid”"

I have a better idea for Denise Savoie. And that’s to follow the leadership of Green Party leader Elizabeth May, who is more interested in facts, than blind faith.

Since the alleged future tax leakage that you are taking for granted is being questioned far and wide.

What use are the NDP, if not as the Newly Duped Party?

After all, you can’t buy groceries in retirement with lowered ATM fees.

The NDP is simply a blind faith organization, happy to serve up kool aid instead of fact based government.

As such, the NDP is a mere charade of democracy.

-

Posted by

Fillibluster

at

1:15 PM

1 comments

![]()

![]()

Where is Parliament on the rape and pillage of Canada's largest telecommunications company: BCE?

The first thing one needs to know about the pending rape and pillage of BCE is that the upcoming CRTC Hearings on the proposed leveraged buyout are public hearings on only the broadcasting assets of BCE and not BCE's vast telecommunications assets. In BCE’s own application to the CRTC, they state that the value of the transaction is $39.8 billion, and the value of the broadcasting asset are $0.1 billion.

As such Parliament should not be looking to the CRTC to necessarily look after and enforce the many policy objectives of the Telecom Act or the Bell Canada Act, that if rigorously applied would render this proposed deal a complete non-starter. Therefore it is incumbent on parliament to enforce the will of these Acts, since the absence of action will come at a stiff price to all Canadians, starting with the annual loss of $800 million in tax revenue at a time when $800 million a year in lost tax revenue means an awful lot.

The rape and pillage of BCE arises from the fact that 80% of BCE's purchase price is coming from BCE itself, 10% from Teachers'. 10% from US private equity. Meanwhile Teachers’ is prohibited by its own regulations from holding more than 30% of the votes of any corporation, directly or indirectly. Hence, the leveraged buyout of BCE is a rape and pillage of the foreign takeover variety.

Here’s what the credit rating agencies are saying:

Standard & Poor’s: on BCE’s resultant credit worthiness:

“The multi-notch downgrade reflects our view that BCE no longer possesses an investment grade financial policy, given the likelihood that the [Teachers’] LBO will be finalized in the near term.

On a pro forma basis, the company will have a highly leveraged capital structure, weakened credit measures, and significantly reduced cash flow-generating capability owing to a dramatic increase in debt and associated heavy interest burden.”

Moody’s Investor Services: on BCE’s resultant credit worthiness:

“With book debt expected to increase by more than 300%, the company’s risk profile will be profoundly affected by the proposed Teachers’ transaction, and its rating could be adjusted by several notches.”

And here’s what BCE”s financial advisor, Goldman Sachs wrote in its letter to BCE’s board back in June:

“We express no opinion as to the impact of the transaction on the solvency or viability of BCE or the ability of BCE to pay its obligations when they become due.”

Reads more like “Over to you, Alphonse.” Which in fact it is. Canadians are Alphonse. Meanwhile Goldman Sachs gets paid $48 million for being the sub-prime mortgage broker of record....provided the CRTC approves this sub prime mortgage deal.

Back in late June 2007. Michael Sabia was trying to put a brave face on the highly criticized sale process that he had just put BCE through, by saying we should all love the outcome for four reasons. Forty Two Seventy Five. As self congratulatory as that statement was, it needs to be understood that $42.75 is also largely self financing, given that the sources of the funds for this proposed takeout are as follows:

BCE : $34.20

Teachers’: $4.27

Providence: $2.75

Madison Dearborn: $1.53

Total: $42.75

So here we have a situation where for 20 cents on the dollar, these private equity firms are able to bulk up with the upside on the entire company. Problem is, the company gets trashed in the process and its junk bond credit rating comes at the cost of about $800 million to BCE’s existing bondholders and Canada’s largest telecommunications company gets saddled with $40 billion of debt that carries a 240 basis point INCREASE in the cots of capital, for what is now 80% of the company’s capitalization.

So what will that mean for BCE’s “competitiveness and efficiency”, which the Telecom Act is designed “to promote”?

What will that mean for the “ownership and control of Canadian telecom by Canadians” that he Telecom Act is designed “to promote’?

One thing is for sure. We know what 240 basis points increase in cost of capital will mean. One need only read the 2003 Report to the Industry Committee of Parliament to get a sense who will be financing this leveraged buyout:

“A higher cost of capital slows the rate of capital investment and, in turn, the roll out of competitive services

A cost of capital differential of approximately 1.18% exists between Canada’s incumbent telephone carriers and Canadian cable companies. This incremental cost equates to about $1.46 per month per cable subscriber.”

So the question becomes, where is Parliament on the rape and pillage of BCE?

"Bell Canada owns the largest phone company in the country and it is also one of the major players in print and broadcast media. Canadian legislation limits the amount of foreign ownership in these sectors and this takeover of

Bell Canada threatens to violate the intentions of those restrictions. I think Prime Minister Harper should send an unequivocal message to the investment community that he will not allow foreign interests to take control of thesekey economic and cultural development industries." David Cole, President of the CEP union.

“One only needs look at the recent sale of Canadian companies like BCE and Alcan to realize who benefits from these shakeups. While senior executives and shareholders pocketed millions of dollars, employees harvested only worry and anxiety. It’s a one-sided proposition that’s weighed totally in favour of the company.” Robert Bouvier, President Teamsters Canada

"At first blush, we're extremely concerned because it does represent one of the largest mergers of this nature in the telecommunications business in Canada. Canadians are already paying too much for their cell phones and we're

going to have to examine very closely the deal. And certainly we would always reiterate that we believe Parliament has a role to play." NDP Party Spokesman Ian Capstick June 2007

“Mr. Speaker, there are news reports of a hostile takeover of BCE. BCE is one of Canada's oldest and largest corporations in Canada.A foreign equity firm wants to snatch it up from underneath Canadians. The company that wants to do this, KKR, is so aggressive, an author entitled a book on KKR, Barbarians at the Gate. I know the government is predisposed to actually selling off Canadian companies and New Democrats understand that the government feels an empathy to do so, but this is a loophole.

I want the Minister of Industry to guarantee right now that he will close this loophole and protect Canadian jobs and BCE.” Brian Masse, NDP Finance Critic in Parliament March 29, 2007

Or is this just another facile exercise by the NDP in lowering ATM fees? All talk No Action

Meanwhile the Quebec separatist party, the Bloc, thinks its okay that one of Quebec’s leading iconic companies ends up in the hands of foreign private equity and ONTARIO Teachers'? And Quebeckers will pay for it with higher phone bills?

Sounds like a plan.

-

Posted by

Fillibluster

at

9:16 AM

3

comments

![]()

![]()

Friday, February 22, 2008

Finance Minister Hugh MacPhie speaks

Would this op ed piece below, that appeared in yesterday's National Post by Finance Minister Hugh MacPhie

have been covered by Hugh MacPhie's original $122,340 contract, or was it covered by one of the many subsequent $24,999.99 contracts?

Let's be honest, Jim Flaherty is incapable of original thought, apart from ”It’s not my fault” or “The panel did it”.

Hence Svengali Mark Carney. Hence Hugh MacPhie.

And to think, Hilary Clinton is accusing Barrack Obama of plagiarism for lifting a few lines from a speech by his National Campaign Co Chair.

Meanwhile Flaherty is programmed 24/7 and no one utters a peep?

Dalton McGuinty is Ontario's biggest problem

National Post

February 21, 2008

by: Jim Flaherty?????

Plagiarism Watch: This just in.

-

Posted by

Fillibluster

at

7:49 AM

10

comments

![]()

![]()

Thursday, February 21, 2008

What assurances are there that BCE’s economics won’t end up in the hands of a sovereign wealth fund?

Photo caption: Minister of Finance, Jim Flaherty, met in Dubai with Sheik Hamdan bin Rashid Al Maktoum, Deputy Ruler and Minister of Finance and Industry of the United Arab Emirates, on January 23, 2008. Minister Flaherty is in the Middle East promoting investment in Canada.

What with the pandemic known as the sub prime mortgage meltdown, and the daily speculation that BCE’s new buyers, Teachers’ and three US private equity firms, will have a difficult time raising the 85% of the "purchase price" that takes the form of $28 billion of junk bond debt being raised by the company itself, the question becomes:

What assurances are there that BCE’s economics won’t end up in the hands of a sovereign wealth fund?

By all press accounts, the BCE leveraged buyout is presently being held together with bailing wire, chewing gum and no shortage of hubris.

Apparently great reputations are at stake. So too, the economics of Canada’s largest telecommunications carrier. With 85% of the purchase price taking the form of new debt to be incurred by the company and only 15% of the purchase price being provided by the “buyers”, the economics of who owns BCE resides with the debt holders, and less so the equity holders.

So who are these new debt holders?

Truth is no one knows. Not even the banks whose job it is to source these debt buyers know. The $28 billion of new debt that BCE needs to raise, as distinct from the $12 billion it already has outstanding, will be provided by a syndicate of banks consisting of Citibank, Deutsche Bank, Royal Bank of Scotland and TD Bank.

Citibank itself has gone through an extremely rough patch as a result of the sub prime mess that it played a central role in and which resulted in Citibank writing off $9.8 billion in bad loans. This major hit to Citibank’s capital required an immediate equity injection. So who did Citibank turn to at a time of distress?

You guessed it. Sovereign wealth funds, , namely $6.8 billion from the Singapore government investment agency GIC, and the Kuwait Investment Authority, who bought a $3 billion stake in Citibank.

So where do you suppose this syndicate of foreign banks is going to go to, once they find themselves “long” about $28 billion of BCE debt that traditional junk debt buyers don’t want to own, or the banks want to hold on their books?

Chances are that the sovereign wealth funds will find themselves faced with the distressed opportunity of a lifetime and will buy this BCE paper at a discount to its face value.

Do you actually think Citibank is going to turn down an offer from the Kuwait Investment Authority to off load its share of $28 billion of BCE junk bond debt at 85-95 cents on the dollar, just because such a sale would contravene the intent of legislation enforced by the CRTC. Give your head a shake. Or sheik, as the case may be.

What does Citibank or the Kuwait Investment Office care about the Bell Canada Act policy objective which reads: “The works of Bell Canada are to be for the general advantage of Canada” or the policy goal of the Telecommunication Act, which is "to promote the ownership of Canadian telecommunications carriers by Canadians?"

It certainly didn’t stop the Kuwait Investment Office back in 1988, when they picked up the largest slice of BCE’s IPO of Bell Mobility, after Wood Gundy failed in underwriting that issue. After Wood Gundy (today CIBC World Markets and an advisor to BCE in its proposed leveraged buyout) failed to complete that IPO. Merrill Lynch swooped in with a "bought deal".

IPOs are never done by way of a “bought deal”. Except however when the dealer has a firm lead order form a sovereign wealth fund like the Kuwait Investment Office, which is exactly what happened with Bell Mobility (then called BCE Mobile) and Merrill Lynch, courtesy of the Kuwait Investment Office back in 1988.

Two closing observations:

Merrill Lynch is one of the three US equity investors alongside Teachers. Merrill Lynch also took a bath on their subprime lending involvement. And like Citibank, they also took an equity infusion from the Kuwait Investment Office.

Is this sounding just a little too incestuous already?

Maybe that’s why the CEO of Teachers’, Jim Leech, recently observed:

“I look forward to the day when [BCE] is out of the public eye.''

Out of sight, out of mind?

Or:

Out of sight, out of Canadian control?

CRTC to the rescue?

Afterall, there is a Canadian solution that BCE failed to disclose to its shareholders and is making every attempt at not disclosing to the CRTC.

And yet, everybody wins with the Catalyst Plan?.

What gives? Who's on first? Or has Teachers' become a mini sovereign wealth fund? Sort of like Quebec. A nation within a nation. A sovereign wealth fund within a once sovereign nation?

By Brent Fullard

Catalyst Asset Management Inc.

-

Posted by

Fillibluster

at

5:15 AM

1 comments

![]()

![]()

Wednesday, February 20, 2008

Sheila Fraser's pipe dream

Canada's Auditor General Sheila Fraser must be smoking something, with her wild and crazy idea that:

"Parliamentarians need objective fact-based information on how well the government raises its funds", which is her mantra from the Auditor General's website.

Meanwhile, in the real world of Federal Fraud Minister Flaherty:

Ottawa won't show details of income trust figures

January 24, 2007

CTV.ca News Staff

The federal Conservatives are refusing to show key details justifying how they concluded that income trusts were costing the government hundreds of millions of dollars in taxes.

Thirteen pages of calculations, released to a Calgary analyst, are so heavily censored with black marker that only row and column labels remain visible.

BMO Nesbitt Burns analyst Gordon Tait received the documents under Canada's Access to Information Act. He also received another 12 pages which include details of trust distributions but those documents have already been made publicly available.

"Do they feel they can't substantiate the tax loss claims that have been made? I can't find another reason why you wouldn't make it available," Tait, a critic of the trust tax introduced last Oct. 31, told The Globe and Mail.

Income trusts are businesses that pay little or no corporate tax. Instead, corporations that convert to trusts pay most of their cash flows to investors in monthly distributions, who in turn pay taxes on this income.

Under the changes, Ottawa will apply a tax on the money distributed to shareholders by newly formed income trusts, shifting the tax burden to investors.

The blacked-out figures are important since Finance Minister Jim Flaherty used them to justify the new levy. But Flaherty's office blocked the details citing a section of the Access to Information Act which permits the withholding of data that could be dangerous to Canada's economic interests.

The law allows officials to keep secret information "which could reasonably be expected to be materially injurious to the financial interests" of the federal government. Information can also be censored if it can negatively influence Ottawa's ability "to manage the economy of Canada" or if it will be of "undue benefit" to anyone.

A second reason given for the censorship was that Finance was allowed to keep secret advice given to ministers.

Tait said he doesn't think the withheld figures contain huge surprises but he says they'd allow Canadians to judge if the estimates are accurate.

"What we want to know is how they took information and processed it to come up with these losses so we know if it's valid or not," he said.

"If you want your data to be accepted, it has to be scrutinized. It's got to be subject to peer review. You can't just come up with your own little theory and not show anybody how you came to it."

Liberal finance critic John McCallum said the censorship shows the need for the parliamentary hearings that will begin next week on the trust tax.

The hearings, prompted by opposition parties, will challenge the government on its tax leakage estimates, McCallum told The Globe.

Posted by

Fillibluster

at

9:14 PM

1 comments

![]()

![]()

How do you spell unaccountable? J i m F l a h e r t y

Let’s be honest. Jim Flaherty is the human embodiment of unaccountable.

Today we learn from our perfect elfin Finance Minister that Dalton McGuinty, and not he, is responsible for the woes in Ontario’s manufacturing sector.

If so, why is Buzz Hargrove calling for Flaherty’s upcoming election defeat and not McGuinty’s?

Flaherty is claiming that Dalton didn’t have sufficient “vision”. This coming from a man who doesn't fix potholes or doesn’t realize how utterly misguided his first 1% cut to the GST was, so he instituted a second 1% cut to the GST.

Here’s Flaherty’s complete disowning of responsibility from today:

Flaherty lashes Ontario for 'lack of vision'

RICHARD BLACKWELL

The Globe and Mail

February 20, 2008 at 10:35 AM EST

Then there was the equally shameful disowning of responsibility on the part of Flaherty concerning the $65 billion in takeovers that were induced by his foreign takeover friendly trust tax. This particular outcome had been predicted by many ever since the evening of Halloween 2006.

Flaherty listen? No

Flaherty acknowledge? No

Flaherty held accountable? You be the judge of this pathetic exercise in accountability:

Trust buyouts not my fault, Flaherty says

TARA PERKINS , STEVEN CHASE and DOUG SAUNDERS

The Globe and Mail

April 3, 2007

Minister rejects criticisms new tax policy is forcing Canadian firms into foreign arms

-

Posted by

Fillibluster

at

4:38 PM

3

comments

![]()

![]()

Jim Prentice: We believe you. Just like we believe Harper's fabricated claims of tax leakage

Just like Harper's fabricated (and fraudulent) claims of tax leakage.

-

Posted by

Fillibluster

at

9:07 AM

5

comments

![]()

![]()

Flaherty appoints two new directors to the Canada Pension Plan Investment Board

Today’s CP news article reads:

“The Canada Pension Plan Investment Board operates at arm´s length from governments”?

and

“Jim Flaherty named two new directors to the Canada Pension Plan investment board”?

A more realistic account is however:

Canada Pension Plan Investment Board: Dabbling in cover-ups at the behest of Harper/Flaherty:

-

Posted by

Fillibluster

at

7:47 AM

2

comments

![]()

![]()

Tuesday, February 19, 2008

Mark Carney is the nexus of the Globe's two top ROB stories

Story #1:

“China shares blame for crisis, Carney says”

Story #2:

“List of Russia’s superrich surpasses 100 mark”

“List of Russia’s superrich surpasses 100 mark”

Reality:

Mark Carney’s fraudulent tax leakage assertions

are intended to solely benefit Canada’s super wealthy. Folks like Paul Desmarais Jr., Dominic D’Allesandro and Gwyn Morgan,

and the members of Corporate Canada’s Controlling Elite (CCCE)

Mark got his training at ripping off the masses when he worked at Goldman Sachs’ working for many of Russia’ oligarchs of today, in the scam known as "privatization" (at pennies on the dollar).

Reality Check #1:

Deloitte

Reality Check #2:

Green Party

-

Posted by

Fillibluster

at

11:54 AM

1 comments

![]()

![]()

Monday, February 18, 2008

$62.5 billion? Mere bagatelle.

Let's assume Harper's claim about $62.5 billion in Liberal spending initiatives were true. It's mere bagatelle relative to Harper's income trust losses.

Stephen Harper is trying to defend his record by attacking the Liberals with a sad exercise in fear mongering, claiming the Liberals will cause a $62.5 billion deficit over 4 years. That works out to a $15.6 billion a year spread over 33 million Canadian for a cost of $472.27 each. Compare that to the 2.5 million income trust investors who are down some $40 billion at this point in time. That works out to $16,000.00 each.

$472.00? $16,000.00?

Harper: Leader? Hypocrite?

Furthermore, the $472 will actually buy something, whereas all the $16,000 bought was $65 billion in trust tax related takeovers

and the annual loss of a further $1.4 billion in taxes. Nothing for everybody.

Stephen Harper: Give your head a shake. You are the problem. Look in the mirror. It’s not a pretty sight. We bought your fear mongering, garbage, election arguments once already. To wit:

“You know where the Liberals stand on raiding seniors nest eggs. A conservative government will never tax income trusts”

Here’s the Liberals response. Somehow, and for some reason, they have become the more credible party, than the Harper, been there, done that, CONs.

-

Posted by

Fillibluster

at

1:07 PM

3

comments

![]()

![]()

Sunday, February 17, 2008

Hey buddy, can you spare a dime?..... $1.4 billion?

Do you suppose another $1.4 billion in annual tax revenue for Ottawa could come in handy now?

The average Canadians who would pay these taxes would be more than happy to continue to pay these taxes. The $65 billion in takeovers that Jim Flaherty and Stephen Harper's ill conceived income trust tax has induced has, according to the accounting firm Deloitte:

Income trust buyouts: Lots of activity, little tax revenue

It’s not like these two morons, Harper and Flaherty, weren’t warned

Trust tax under fire as drain on revenue

As for Flaherty. He is defined more by what he doesn’t do that what he does do, with his statement of February 11, 2008:

"I'm not going to be the finance minister that puts our country back into deficit," Mr. Flaherty told reporters.

How very reminiscent of his statement of November 1, 2006

in support of that rash action of the day:

“We were going to see the two largest telecommunications companies in the country not pay corporate taxes. That's a clear and present danger to fairness in the Canadian tax system. I thought we had to act.”

Had Flaherty been even remotely competent, he would have realized that neither Telus nor BCE were paying taxes as a corporation, and would have paid $3.8 billion more in taxes as trusts over 4 years

Fast forward 18 months later and we see that BCE will pay zero taxes as a foreign leveraged buyout, resulting in the loss of $800 million a year in taxes.

The good new is, however, that $800 million of that $1.4 billion loss in taxes caused by the trust taxation blunders arises from the Teachers "back door" foreign takeover of BCE. That deal still requires CRTC approval, and there are a host of reasons why the CRTC should nix it, the loss of significant tax revenue being just one.

As for the various Acts that the CRTC administers, do you suppose the Bell Canada Act had the tax stripping of Bell's pretax income by foreign private equity and junk bond lenders in mind when they penned the words:

"the works of Bell Canada are to be for the general

advantage of Canada"?

No doubt Teachers'. Providence Capital LLC, Madison Dearborn LLC and Merrill Lynch Capital Partners LLC have 800 million other good reasons why their deal provides such an outcome.

If they do, then it would simply be a break even proposition, at best.

If they don't, they should be told to go to the back of the bread line, and rub their two nickels together to keep warm.

-

Posted by

Fillibluster

at

9:28 AM

4

comments

![]()

![]()

Saturday, February 16, 2008

Déjà vu all over again: Flaherty’s fiscal and integrity deficit

The definition of insanity is to do the same thing over and over again, and expect a different result.

Such is the case with Jim Flaherty, one of the most untrustworthy politicians to ever hold fiscal office in this country.

This is the fine gent who professed he had balanced Ontario’s books in 2003, only for Ontarians to learn upon a change in government that Flaherty had left behind a $6 billion deficit, as uncovered by Provincial Auditor Erik Peters, and reported:

Ontario's former Conservative government left the province with a $5.6-billion deficit, a retired provincial auditor said Wednesday.

The provincial shortfall exceeded earlier estimates, which had been around $2-3 billion.

Peters recommended the Liberal government consider new legislation dealing with fiscal responsibility, including greater transparency in budgets and updates.

When asked if the Tories would have been briefed on the province's financial situation before the March budget, Peters said in the normal course of events, the finance minister would have been informed.

"Ontario has a clear and unvarnished understanding of our financial situation," said Sorbara.

He accused the Tories of "misrepresenting" the province's financial situation.

So now we have Jim Flaherty professing that his recent binge of spending programs and tax reductions, like the most recent cut in the GST, will not imperil the country’s long record of budgetary surpluses,

Why would anyone possibly believe the man?

Remember what the definition of insanity is.

Flaherty is inherently untrustworthy. He lacks integrity and credibility. He is fraudulent by nature.

Need I mention Hugh McPhie & Co.?

-

Posted by

Fillibluster

at

9:14 PM

4

comments

![]()

![]()

Probe role of RCMP in last vote, probe NDP's complicity

What role did Judy Wasylycia-Lies, Jack Layton and Stephen Harper play in this scam set up with the RCMP? Judy was at her most shrill. Jack at his most duplicitous and Stephen was just the Stephen we have come to know.

Jim Travers' reference to banana republic pretty much sums it up.

Probe role of RCMP in last vote

Feb 16, 2008 04:30 AM

James Travers

The Toronto Star

"What is known, or at least what informs conventional wisdom here, is that it was the election's tipping point. Before the RCMP repeatedly flashed its investigation to the NDP, Liberals held a lead and Paul Martin was on course for a second minority mandate. But that changed when now defrocked commissioner Giuliano Zaccardelli dumped customary discretion by reporting to MP Judy Wasylycia-Leis that the RCMP was on the case. Surprise, surprise, she rushed to the microphone about as quickly as voters reached the conclusion that Liberals and their ethics were beyond the pale.

Whatever the truth, it's remarkable that Bill Elliott, labouring under the twin burdens of being the first civilian commissioner and old Tory ties, has yet to clear the air. Instead, it's heavy with the spoiled odours of banana republics.

Before the next election, Canadians have a right to know if the RCMP was more than a spectator in the last. Nothing less will do."

-

Posted by

Fillibluster

at

8:13 PM

2

comments

![]()

![]()

The schizophrenic Globe and Mail

Having done more than its fair share to propagate the Harper government’s lies about tax leakage, as Jim Flaherty’s and Mark Carney’s fraudulent rationale to kill income trusts, the Globe and Mail is now doing its best at fulfilling item 2 of Goldman Sachs' wish list being executed by Goldman Sachs alumni Mark Carney, and that is to advise Canadians who are hungering for high yielding equity investments to "look south", and invest in the US market.

Perhaps they could follow this piece up with a piece on the $480 billion US Master Limited Partnership (MLP) market, since the MLP market is the exact parallel to the Canadian income trust market.

That would be quite the revelation for Globe’s readers, since our Minster of Finance, who doubles as the Minister of Fraud, told Canadians that the US had shut down their income trust equivalent market. Too bad no one in the press did a little deeper digging.

Which only goes to show. Don’t trust politicians. Don’t trust the Globe.

They are both too interested in "shaping the truth" rather than "reporting the truth".

Today’s article entitled “Want some dividend excitement? Look south” is the inevitable follow up story to these virulent gems of the past whose sole focus was to mislead Canadians about the false notion of tax leakage in order to kill income trusts:

Capitalism for slobs.

By Eric Reguly. March 2005 Report on Business

Income trusts are turning Canadian CEOs and investors into coupon-clipping couch potatoes

Income trusts are the glazed doughnuts of the financial world, and the investors who gorge on them are becoming fat and happy. Soon, they will become lethargic, their arteries and brains clogged with trust lard. And what's bad for investors is also bad for corporate Canada.

Trust lobbyists, that's enough of your fury

By Eric Reguly. December 2006 Report on Business

"Someone should encase income trust lobbyists in concrete and fling them off a bridge into deep water. On second thought, forget it; even that wouldn't stop the misguided creatures. Houdini-like, they would somehow break free and call for Jim Flaherty's head the moment their lips broke the surface. They are unstoppable and insatiable.

Still, the trusts lobbyists are lusting for blood, as if it's their god-given right to determine tax policy. They should be ignored."

Trust lobby had no hope against Flaherty

By Eric Reguly. February 1, 2007 Report on Business

If the expanding array of income trust lobby groups were to emboss their stationery, they might consider the image of Sisyphus, the symbol of hopeless labour. The lobbyists keep pushing the rock up to Jim Flaherty's door only to have it roll back upon them with great squishing sounds. Repeat process, repeatedly.

There’s no arguing with the man (Flaherty), and the trust’s disjointed effort only made it easier for him to say no

Of all the venomous comments that the Globe has falsely advanced about income trusts, the worst one of all, wasn't even about income trusts. It was the admonishment that "they should be ignored".

I can't think of a more ignorant and intolerant piece of advice to be handed out in a newspaper, than to ignore the other side of an argument.

What's next? Book burning?

At the Globe and Mail, apparently ignorance is bliss. Both in terms of their readers and certainly amongst the news staff.

That's probably why their investment advice of today and their readership of tomorrow is headed the same direction: ”Look south.”

-

Posted by

Fillibluster

at

8:24 AM

5

comments

![]()

![]()