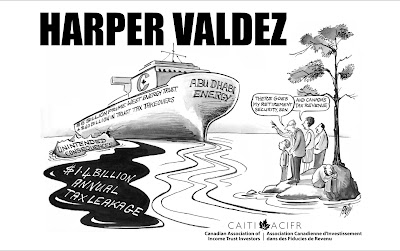

Do you suppose another $1.4 billion in annual tax revenue for Ottawa could come in handy now?

The average Canadians who would pay these taxes would be more than happy to continue to pay these taxes. The $65 billion in takeovers that Jim Flaherty and Stephen Harper's ill conceived income trust tax has induced has, according to the accounting firm Deloitte:

Income trust buyouts: Lots of activity, little tax revenue

It’s not like these two morons, Harper and Flaherty, weren’t warned

Trust tax under fire as drain on revenue

As for Flaherty. He is defined more by what he doesn’t do that what he does do, with his statement of February 11, 2008:

"I'm not going to be the finance minister that puts our country back into deficit," Mr. Flaherty told reporters.

How very reminiscent of his statement of November 1, 2006

in support of that rash action of the day:

“We were going to see the two largest telecommunications companies in the country not pay corporate taxes. That's a clear and present danger to fairness in the Canadian tax system. I thought we had to act.”

Had Flaherty been even remotely competent, he would have realized that neither Telus nor BCE were paying taxes as a corporation, and would have paid $3.8 billion more in taxes as trusts over 4 years

Fast forward 18 months later and we see that BCE will pay zero taxes as a foreign leveraged buyout, resulting in the loss of $800 million a year in taxes.

The good new is, however, that $800 million of that $1.4 billion loss in taxes caused by the trust taxation blunders arises from the Teachers "back door" foreign takeover of BCE. That deal still requires CRTC approval, and there are a host of reasons why the CRTC should nix it, the loss of significant tax revenue being just one.

As for the various Acts that the CRTC administers, do you suppose the Bell Canada Act had the tax stripping of Bell's pretax income by foreign private equity and junk bond lenders in mind when they penned the words:

"the works of Bell Canada are to be for the general

advantage of Canada"?

No doubt Teachers'. Providence Capital LLC, Madison Dearborn LLC and Merrill Lynch Capital Partners LLC have 800 million other good reasons why their deal provides such an outcome.

If they do, then it would simply be a break even proposition, at best.

If they don't, they should be told to go to the back of the bread line, and rub their two nickels together to keep warm.

-

Sunday, February 17, 2008

Hey buddy, can you spare a dime?..... $1.4 billion?

Posted by

Fillibluster

at

9:28 AM

![]()

![]()

Subscribe to:

Post Comments (Atom)

4 comments:

Newfoundland has Flaherty nailed.

http://www.thetelegram.com/index.cfm?sid=108961&sc=86

Make that:

http://www.thetelegram.com/index.

cfm?sid=108961&sc=86

Jim Flaherty is a walking disaster--he has caused more harm to this economy than most will ever know.

From past Experience with Jim as Finance Minister here in Ontario , I can say without a doubt that this man cannot be trusted--he told us that he had a surplus of cash in the kitty when he left his post as minister--now we have come to know the truth--it was really a 6 billion dollar deficit.

This man obviously cannot count or he is under the mistaken impression that it is his right to be completely dishonest for political gain.

It scares me to no end to think this guy has aspirations to become Prime Minister--if that ever happens , it will be time to pucker up & kiss our asses goodbye.

Mike.

Diane Francis, Financial Post

Published: Friday, April 20, 2007

Ned Goodman blasted the Tories for their ignorant economic policies, and took aim at Canada's pension funds, too, while he was at it.

"Income trusts were a competitive advantage for Canadian companies in terms of lower capital cost," he said in a recent interview in his Toronto office. "Now all the income trusts are going to be taken over by pension funds or private equity, neither of which will pay any taxes."

That's what is so disappointing today.

Post a Comment